Member News ~ March 27, 2025

Danville's 39th Spring Fling

The festivities take place on Mill St. from Rt. 11 to Front St.; Lower Mulberry to Ferry St.; and a portion of East and West Mahoning Streets and East and West Market Streets. Saturday, May 3rd from 9am to 4pm. Learn More

Bloomsburg Children's Museum Announces April Programs

Click Here for more information

LIVIC Civil Invests in Regional Promotion for Regional Growth in Central PA

LIVIC Civil contributed $1,000 gold level mission investment in Focus Central Pennsylvania for 2025. These resources are to advance the mission to attract investment that cultivates economic growth in Central PA. Learn More

Sean Black State Farm Insurance hosts photo contest

This year's categories are People, Nature, Places, and Miscellaneous. Limit one entry per category. For more information and to submit your photos reach out to stephanie@insureberwick.com by May 16 at 8 p.m. to be considered!

The Stuart Tank Memorial Association Launches New Website

Click here to stay up to date with their upcoming events, museum hours, directions to the museum, and more!

MARC takes on Disc Golf Project at Briar Creek Lake Park

The Montour Area Recreation Commission (MARC) will host a public information session regarding the Briar Creek Lake Park Disc Golf Project on Wednesday, April 9, from 6:30pm to 7:30pm, at the Briar Creek Township municipal building (150 Municipal Rd, Berwick, PA 18603). Those wishing to join this meeting through Zoom are asked to email Bob Stoudt, MARC Director, at RStoudt@MontourRec.com to register for the session and receive the meeting login information.

Senator Lynda Culver hosts Free License Plate Exchange

Visit the Montour Township Police Department on April 11th from 11am-1pm to receive a new license plate. All paperwork and services are 100% free. Learn More

YOUR PERSPECTIVE MATTERS - Take the Creative Workforce Survey from the Pennsylvania Council on the Arts

Their goal is to better understand the people and jobs that comprise Pennsylvania's creative workforce and creative industries. The survey is anonymous and does not include any questions that involve personally identifying information. Take the survey here.

Bloomsburg Town Updates

The Bloomsburg Council approved Jodi Reichart as the new Administrative Finance Receptionist. Jodi holds a four-year degree in Mass Communications from Bloomsburg University. To reach Jodi, email finance@bloomsburgpa.org

SBDC Hosts 'Starting A Small Business' Seminar

For more information, click here

Did You Miss Last Week's Member News? Here's News That's Still Timely

Leadership Central Penn Class Project Help

Join members of the 2025 class of Leadership Central Penn as they work with the Red Cross to install free smoke alarms on April 5th. Learn more and sign up to volunteer here.

Talen partner with EMAs to update alert and notification methods

Talen and Luzerne County EMA (LCEMA) and Columbia County EMA (CCEMA) decided to update alert and notification methods for nuclear emergencies to align them with those used for other emergencies. The changes have been approved by FEMA and the NRC and will be implemented April 1, 2025. Learn more.

Bloomsburg Rotary's Annual Peanut Butter and Jelly Drive is happening now

Join the Bloomsburg Rotary in their annual Peanut Butter and Jelly Drive. Find a drop-off location here. The drive runs now through April 18th. They have a goal of collecting 2,025 pounds of peanut butter and jelly! Monetary donations can be made to the club to purchase PNB and Jelly by mailing contributions to P.O. Box 842, Bloomsburg,PA,17815

Women's Giving Circle will hold next "On the Bright Side" April 17th

Join the Women's Giving Circle on April 17th at noon for our next "On the Bright Side" virtual session. Led by presenters Cynthia Schroll and Sally Meyer, both avid gardeners and members of the Fishing Creek Herb Guild, we'll look at the many benefits of including native plants and herbs in your gardening plans for this season. Register here.

Bloomsburg Children's Museum: Strawberry Jam Making Class

Attention Central PA Manufacturers!

Your insights are crucial! IMC is surveying Manufacturers to understand how the proposed tariffs will impact your business in Central PA. Take the survey here.

LCBC Hosting Annual Global Leadership Summit

LCBC will be one of several national locations hosting the Global Leadership Summit on August 7 -8. Learn more about speakers and how to register.

Volunteer Income Tax Assistance (VITA) is now accepting appointments!

Our VITA Program is now accepting appointments. Please let your clients know they can get their state, federal, and local taxes done for FREE. You can book appointments from now through April 5th. You can book your appointment online at https://svuw.org/vita or call (570) 416-2704 and leave a voicemail, and a VITA volunteer will return your call as soon as possible.

Ronald McDonald House of Danville hosting Garden Party

Join the Ronald McDonald House of Danville for a captivating evening at the second annual Garden Party at Dark. Learn more here.

DCDC Dueling Pianos Back April 4th

Danville Child Development Center's Annual Dueling Pianos Event is happening April 4th. Learn more..

Bloomsburg ArtFest Announced, Applications Live

The seventeenth ArtFest will occur on Saturday, August 23, 2025, from 10:00 AM to 5:00 PM. ArtFest showcases regional artists' original work, accompanied by local food, live music, and activities. More details here. Read the call for entries.

NEW MEMBER HIGHLIGHT- Berwick Golf Club

The Berwick Area Golf Club has long been a pillar of the community, offering a welcoming atmosphere where golfers can enjoy the game while appreciating the natural beauty of the region. Known for its challenging yet accessible course, the club prides itself on maintaining high standards of course upkeep, ensuring that every round played is both enjoyable and memorable. It features practice facilities for golfers, a full-service bar and restaurant, and space for events and banquets The Berwick Golf Club is more than just a golf course—it’s a place where lasting memories are made. For more information about the Berwick Golf Club click here.

The Berwick Area Golf Club has long been a pillar of the community, offering a welcoming atmosphere where golfers can enjoy the game while appreciating the natural beauty of the region. Known for its challenging yet accessible course, the club prides itself on maintaining high standards of course upkeep, ensuring that every round played is both enjoyable and memorable. It features practice facilities for golfers, a full-service bar and restaurant, and space for events and banquets The Berwick Golf Club is more than just a golf course—it’s a place where lasting memories are made. For more information about the Berwick Golf Club click here.

Effective Inventory Control for Nonprofits

Source: McKonly & Asbury

Implementing effective inventory controls is crucial for any nonprofit organization to ensure that their resources are managed efficiently. Without proper inventory controls, an organization runs the risk of misallocating resources which could lead to failing to meet their mission’s objectives. This article outlines three practices a nonprofit entity can utilize to help maintain effective inventory controls.

Implementing effective inventory controls is crucial for any nonprofit organization to ensure that their resources are managed efficiently. Without proper inventory controls, an organization runs the risk of misallocating resources which could lead to failing to meet their mission’s objectives. This article outlines three practices a nonprofit entity can utilize to help maintain effective inventory controls.

Establishing a Clear Inventory Policy

When establishing an inventory policy, it is important for management to outline processes for various fundamental areas, such as the following.

- Valuation

Deciding how the organization will value their inventory is not only relevant for financial reporting and budgeting but is also vital in the application process for various funding sources. Many federal and state funding sources require organizations to disclose how inventory is valued on an annual basis. As mentioned in a previous article, there are several appropriate methodologies that an organization can implement when considering the valuation of inventory. - Receiving

A well-functioning receiving department plays a critical role in ensuring efficient inventory management. This includes verifying all incoming shipments against purchase orders or donation listings to help identify any discrepancies and maintain precise records. Additionally, the department should be responsible for properly sorting and storing items in designated locations within the organization’s warehouse, store, or other storage areas. - Distribution

The distribution department should keep accurate picking and packing slips, labels with tracking numbers, and bills of lading to acknowledge the transfer of goods to the recipients. These control documents provide clear documentation and help alleviate the risk of items leaving the organization without a form of authorization or inventory tracking.

- Valuation

Utilizing Inventory Cycle Counts

Implementing cycle counts and full physical counts helps ensure inventory accuracy by management. Cycle counts can take several forms, such as counting a small amount of your inventory on a specific day, with the frequency varying depending on the size of the organization. Other popular types of cycle counts include random selections, location-based sampling, and selections tailored to the frequency purchased of high-value or high-usage items. To maximize the benefits of cycle counting, management should ensure all items are subjected to counts at least once throughout the year. To supplement these scheduled cycle counts, an annual full physical count around the time of year-end close should then be performed. For more in-depth explanations on these various approaches, follow here.

Maintaining Security

Inventory security controls take various forms, including:

- Physical access restrictions: Monitoring who has physical key access, requiring individual security codes, or an integrated badge system that only gives access to those with approved clearances.

- Audit logs: Accounting for day-to-day inventory actions with proper signoffs that track inventory movement.

- Theft prevention policies: Requiring all individuals affiliated with the organization to sign and acknowledge their commitment to theft prevention. This includes all employees, volunteers, and anyone else who has access to inventory, and this reinforces zero-tolerance for theft and outlines clear consequences.

Conclusion

Successful inventory management starts with careful planning and clear policies for specific inventory functions and controls. Organizations that take a proactive approach to inventory management by prioritizing these strategies can shift their focus to their core mission and continue serving their communities effectively.

Please reach out to a member of McKonly & Asbury's Nonprofit team for more information on the topic outlined above. You can also learn more about our nonprofit services by visiting McKonly & Asbury's Nonprofit industry page.

The post Effective Inventory Control for Nonprofits appeared first on McKonly & Asbury.

Maker vs. Manager: Mastering Two Distinct Leadership Modes to Maximize Your Impact

- Leaders wear two hats: Makers create; Managers coordinate. Each requires different energy and time structures.

- Switching comes at a cost: Moving between modes drains productivity and increases burnout risk.

- Design your schedule with intention: Block Maker time for focus, Manager time for collaboration.

- Model healthy rhythms for your team: When leaders respect focus time, teams follow.

645 words ~ 3 min read

The Scenario: You’ve blocked off the morning to finally finish that big proposal. You’re ready to focus, dive deep, and knock it out. By 9:30 a.m., you’ve already been pulled into two quick meetings, responded to Slack messages, and answered a “just one quick thing” email. Suddenly it’s noon, and your deep work window is gone. Sound familiar?

The Scenario: You’ve blocked off the morning to finally finish that big proposal. You’re ready to focus, dive deep, and knock it out. By 9:30 a.m., you’ve already been pulled into two quick meetings, responded to Slack messages, and answered a “just one quick thing” email. Suddenly it’s noon, and your deep work window is gone. Sound familiar?

For most leaders, this tension isn’t new. Balancing creation with coordination is the hallmark of modern leadership. But few people talk about how draining it can be to switch back and forth between these two distinct modes of work. As Alex Hormozi (https://www.acquisition.com/about-alex) puts it, success depends on recognizing—and respecting—the different demands of the Maker and Manager work styles.

Maker vs. Manager: Two Modes, Two Rhythms

The Maker Mode

Makers are creators. They add value by building things—whether that’s writing content, developing products, designing strategies, or solving complex problems. Their work requires deep concentration and long, uninterrupted time blocks. A five-minute interruption can cost them hours in lost focus and productivity.

Think Bill Gates’ famous “Think Weeks,” where he isolates himself to read, think, and strategize.

For Makers, success depends on flow, creativity, and undivided attention.

The Manager Mode

Managers are the facilitators and coordinators. Their value comes from decision-making, communication, and oversight. They excel at moving between tasks quickly, leading meetings, providing feedback, and unblocking teams. Their schedules are often packed with interactions that require quick thinking and rapid context switching.

Sheryl Sandberg, during her time at Meta, was known for a highly structured calendar filled with meetings designed to move the organization forward.

For Managers, success looks like clarity, decisiveness, and team coordination.

Why This Distinction Matters for Leaders

Switching between Maker and Manager modes isn’t seamless. Every transition comes with a cognitive cost. You can’t walk out of a high-stakes meeting and instantly drop into deep strategy work. It can take up to 25 minutes to regain full focus after a single interruption (source: Forbes).

Leaders who ignore this reality risk:

- Burnout

- Reduced productivity

- Frustration—for themselves and their teams

But those who master these two modes can dramatically increase their impact. It’s not about choosing Maker or Manager. It’s about knowing when to operate in each mode—and protecting that time.

4 Practical Strategies to Master Both Modes

- Audit Your Week

Are you spending your time intentionally as a Maker or Manager? Track your time for a week to understand where your energy is going. - Time Block with Purpose

Dedicate distinct parts of your day to each role. For example, schedule deep Maker work in the morning when your focus is strongest, and Manager tasks in the afternoon when collaboration is key. - Protect Your Maker Time Relentlessly

Turn off Slack and email notifications. Decline unnecessary meetings. Create a “Do Not Disturb” window and honor it. This signals to your team that you value deep work—and they should too. - Cluster Your Manager Tasks

Batch meetings, calls, and decision-making sessions. This keeps you in a coordination mindset, avoiding constant mode-switching that saps energy.

The Leadership Edge: Modeling Healthy Work Rhythms

This isn’t just about personal productivity. Leaders set the tone for their organizations. When you model intentional Maker and Manager time, you give your team permission to do the same. The result?

- More focused teams

- Better decision-making

- Less burnout

- More innovation

As Paul Graham wrote in his essay, Maker’s Schedule, Manager’s Schedule, “When you're operating on the maker's schedule, meetings are a disaster.” True then. Still true today.

The Bottom Line

The best leaders aren’t just good Makers or Managers. They’re intentional about how—and when—they show up in each role. In today’s complex business environment, adaptability is a superpower. But adaptability doesn’t mean multitasking.

It means designing your time to win.

For Further Reading:

Paul Graham: Maker's Schedule, Manager's Schedule

Forbes: The True Cost of Interruptions At Work (And How To Avoid Them)

HBR: How to Structure Your Day for Maximum Productivity

---

The Columbia Montour Chamber of Commerce is a private non-profit organization that aims to support the growth and development of local businesses and our regional economy. We strive to create content that not only educates but also fosters a sense of connection and collaboration among our readers. Join us as we explore topics such as economic development, networking opportunities, upcoming events, and success stories from our vibrant community. Our resources provide insights, advice, and news that are relevant to business owners, entrepreneurs, and community members alike.

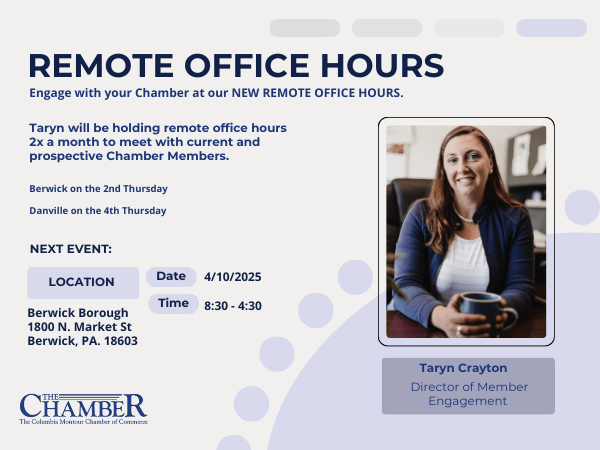

Strengthening Connections: Monthly Presence in Our Communities

Chris often says, “If you have seen one chamber, you have seen one chamber.” That sentiment continues to inspire my approach to member engagement. When I joined the Chamber as Director of Member Engagement, I set out to truly see and understand our Chamber by personally meeting with nearly 100 members. Through these conversations, I’ve gained invaluable insight into our diverse business community—manufacturers sending products around the globe, companies that have been in business for 20, 80 even 150 years, and the daily challenges our members navigate.

Chris often says, “If you have seen one chamber, you have seen one chamber.” That sentiment continues to inspire my approach to member engagement. When I joined the Chamber as Director of Member Engagement, I set out to truly see and understand our Chamber by personally meeting with nearly 100 members. Through these conversations, I’ve gained invaluable insight into our diverse business community—manufacturers sending products around the globe, companies that have been in business for 20, 80 even 150 years, and the daily challenges our members navigate.

Now, as I step into my third year at the Chamber, I’m focused on deepening those connections and strengthening our presence across Columbia and Montour Counties. One of the ways we’re putting this into action is by establishing “remote” office hours across our two-county footprint. I’m pleased to announce that I’ll be available to members and prospective members in Berwick on the second Thursday of each month and in Danville on the fourth Thursday. Whether you have questions, want to share insights, or simply want to chat over coffee, I’ll be there with remote office hours at a variety of member locations.

I encourage you to check out our weekly Wednesday E-Biz newsletter to find the location I will be at! If you would like to set up a specific time to meet email me at tcrayton@columbiamontourchamber.com or just stop by and say hello!

This initiative is part of our ongoing commitment to accessibility, engagement, and support for all our members. Your input and involvement continue to shape our efforts, and I look forward to building even stronger connections together. Click here if you are interested in Berwick, or click here if you are interested in Danville. See you soon!

Member News ~ March 20, 2025

Innotek hosts Cyber Games March 24th!

Learn to stop scammers with eye-opening videos that expose how phishing, vishing, and smishing attacks works- so you can spot scams before they catch you. Click here for more information

Susquehanna Valley United Way Names Mark Stankiewicz as New CEO

Susquehanna Valley United Way (SVUW) is excited to announce the appointment of Mark Stankiewicz as its new President and Chief Executive Officer. Learn more about Mark.

Community Giving Foundation hires Marketing Assistant

The Community Giving Foundation is excited to welcome Danny Hess to the Foundation team as marketing assistant. Learn more about Danny here.

Leadership Central Penn Class Project Help

Join members of the 2025 class of Leadership Central Penn as they work with the Red Cross to install free smoke alarms on April 5th. Learn more and sign up to volunteer here.

Focus Central PA receives $1000 in support

The contribution provides the organization with the resources to effectively market Central PA. Learn more.

Talen partner with EMAs to update alert and notification methods

Talen and Luzerne County EMA (LCEMA) and Columbia County EMA (CCEMA) decided to update alert and notification methods for nuclear emergencies to align them with those used for other emergencies. The changes have been approved by FEMA and the NRC and will be implemented April 1, 2025. Learn more.

Bloomsburg Rotary's Annual Peanut Butter and Jelly Drive is happening now

Join the Bloomsburg Rotary in their annual Peanut Butter and Jelly Drive. Find a drop-off location here. The drive runs now through April 18th. They have a goal of collecting 2,025 pounds of peanut butter and jelly!

Women's Giving Circle will hold next "On the Bright Side" April 17th

Join the Women's Giving Circle on April 17th at noon for our next "On the Bright Side" virtual session. Led by presenters Cynthia Schroll and Sally Meyer, both avid gardeners and members of the Fishing Creek Herb Guild, we'll look at the many benefits of including native plants and herbs in your gardening plans for this season. Register here.

Wilkes SBDC hosting Intro to QuickBooks Class March 24th

This webinar is presented by Sherrima Sharif, QuickBooks certified Pro Advisor, and Accounting Services Program Manager for the PA SSBCI (State Small Business Credit Initiative) program and hosted by Wilkes University SBDC. This workshop is presented for those small business owners with the online version of QuickBooks, and may not be as relevant for those with the desktop version license. Register here.

Did You Miss Last Week's Member News? Here's News That's Still Timely

Bloomsburg Children's Museum: Strawberry Jam Making Class

Attention Central PA Manufacturers!

Your insights are crucial! IMC is surveying Manufacturers to understand how the proposed tariffs will impact your business in Central PA. Take the survey here.

Bloomsburg Public Library Announces Programing

LCBC Hosting Annual Global Leadership Summit

LCBC will be one of several national locations hosting the Global Leadership Summit on August 7 -8. Learn more about speakers and how to register.

Shows at The Weis Center

- Ukrainian world music ensemble DakhaBrakha on Thursday, March 20 at 7:30 p.m

- Classical ballet ensemble Houston Ballet II on Friday, March 28 at 7:30 p.m

PATHS will offer over 50 Programs in March

PATHS will offer over 50 trainings in March to educate you on ladder safety, poison prevention, and active shooter. Visit their website, Health & Safety Division | Department of Labor and Industry | Commonwealth of Pennsylvania, for other safety-related resources and to register for a training!

Camp Victory Bingo Event

Camp Victory is hosting a Bingo Fundraiser on March 22nd. Click here for more information.

Volunteer Income Tax Assistance (VITA) is now accepting appointments!

Our VITA Program is now accepting appointments. Please let your clients know they can get their state, federal, and local taxes done for FREE. You can book appointments from now through April 5th. You can book your appointment online at https://svuw.org/vita or call (570) 416-2704 and leave a voicemail, and a VITA volunteer will return your call as soon as possible.

Ronald McDonald House of Danville hosting Garden Party

Join the Ronald McDonald House of Danville for a captivating evening at the second annual Garden Party at Dark. Learn more here.

DCDC Dueling Pianos Back April 4th

Danville Child Development Center's Annual Dueling Pianos Event is happening April 4th. Learn more..

Bloomsburg ArtFest Announced, Applications Live

The seventeenth ArtFest will occur on Saturday, August 23, 2025, from 10:00 AM to 5:00 PM. ArtFest showcases regional artists' original work, accompanied by local food, live music, and activities. More details here. Read the call for entries.

Chambers Weigh Proposed Bills

The Columbia Montour Chamber of Commerce is a proud partner of the Pennsylvania Chamber of Business and Industry, which advocates for a competitive and vibrant business climate in Pennsylvania. Earlier this week, the PA Chamber released updates about pending legislation that will impact businesses in Columbia and Montour Counties and across the Commonwealth.

The Columbia Montour Chamber of Commerce is a proud partner of the Pennsylvania Chamber of Business and Industry, which advocates for a competitive and vibrant business climate in Pennsylvania. Earlier this week, the PA Chamber released updates about pending legislation that will impact businesses in Columbia and Montour Counties and across the Commonwealth.

As a courtesy to our members, we're pleased to share this critical information so that you may engage with the legislative matters that mean the most to you, and so that we can continue to advocate on your behalf. To share your perspective on these and any other matter that affects the way you do business, please connect with the Columbia Montour Chamber’s Governmental Affairs Committee by calling 570-784-2522 or emailing Chris Berleth, President at cberleth@columbiamontourchamber.com.

H.B. 78, P.N. 65 – Data Privacy

Description

House Bill 78 would regulate the collection and use of consumers’ personal data by providing consumers with certain rights and requiring businesses to protect and limit the collection of personal data.

Impact on Business

The PA Chamber believes a national framework for data privacy regulation would be preferable to protect consumer data, promote transparency, and provide regulatory certainty in the marketplace. Congress, however, has not yet advanced consumer data privacy legislation and in the meantime, 20 states have adopted a patchwork of data privacy laws. We have advocated that if lawmakers are to advance data privacy legislation at the state level, they look to states such as Virginia and Connecticut, which crafted their laws with input from the business community. Some concerns remain that the low threshold for covered entities (having the data of 50,000 individuals) and short compliance window (6 months) will make it difficult for small businesses. We support an amendment that will be offered in committee to extend the effective date to one year.

PA Chamber of Business and Industry position:

AMEND

STATUS:

Vote Scheduled in House Commerce Committee

H.B. 81, P.N. 32 – Prohibiting Paper Statement Fees

Description

House Bill 81 would amend existing Unfair Trade Practices and Consumer Protection Law to prohibit businesses from charging a fee for paper account statements, creating a new private right of action

Impact on Business

This legislation has broad-reaching implications for the business community, including opening the door to the government getting involved in price-setting and ongoing enhanced fraud concerns when financial statements go through the mail. If enacted, HB 81 designates charging paper account statement fees as an unfair trade practice under Pennsylvania law and creates a new private right of action. Additionally, there is a need for additional exemptions to be included in the bill for already regulated industries. There is a strong likelihood that if enacted, HB81 would face a constitutional challenge due to previous case law in other jurisdictions which established that prohibiting fees for paper billing statements violates the First Amendment rights of businesses.

PA Chamber of Business and Industry position:

OPPOSE

STATUS:

Vote Scheduled in House Consumer Protection, Technology, and Utilities Committee

H.B. 43, P.N. 22 – Drilling Permit Notice Requirement

Description

House Bill 43 would require published notice to residents when filing drilling permits.

Impact on Business

This legislation is duplicative and creates other problems and delays in the well-permitting process.

PA Chamber of Business and Industry position:

OPPOSE

STATUS:

Vote Scheduled in House Environmental & Natural Resources Committee

H.B. 586, P.N. 595 – Food Processing Residuals

Description

House Bill 586 would require permits and licenses and create reporting requirements for spreading food processing residuals.

Impact on Business

A Food Processing Residual (FPR) is an incidental organic material generated by processing agricultural commodities for human or animal consumption. The food processing industry currently sources FPRs to the agriculture sector to improve soil health and increase yields. Concerns have been raised by both the food processing and agricultural industries that this legislation would make it difficult to maintain this practice.

PA Chamber of Business and Industry position:

OPPOSE

STATUS:

Vote Scheduled in House Environmental & Natural Resources Committee

H.B. 597, P.N. 2741 – Residual Food Processing Waste & Certification for FPR Haulers and Brokers

Description

House Bill 597 establishes the hauler or broker of food processing residuals certification program; provides for the transportation of food processing residuals; imposes duties on the Department of Agriculture and the State Conservation Commission; and imposes penalties

Impact on Business

Similar to H.B. 586, concerns have been raised by both the food processing and agricultural industries that this legislation would make it difficult to maintain sourcing FPRs to the agriculture sector

PA Chamber of Business and Industry position:

OPPOSE

STATUS:

Vote Scheduled in House Agriculture Committee

H.B. 620, P.N. 631 – Municipal Waste Fees

Description

House Bill 620 proposes to increase the Recycling Fee to $5/ton to generate more funds going into the program in support of increased costs and demands for those dollars.

Impact on Business

The proposed increase in the Recycling Fee will raise the cost of essential services provided to Pennsylvania citizens and businesses and only adds to household costs for already-struggling Pennsylvanians as food, utility and gas bills all continue to increase.

PA Chamber of Business and Industry position:

OPPOSE

STATUS:

Vote Scheduled in House Local Government Committee

H.B. 660, P.N. 620 – Mandatory Efficiency Standards

Description

House Bill 660 mandates energy and water efficiency standards to commercial and residential appliances sold in the Commonwealth

Impact on Business

While we appreciate the intent of this legislation, Imposing energy and water efficiency standards that are more stringent than federal levels will create additional costs for many businesses already grappling with inflation, supply chain challenges, and workforce shortages. At a time when businesses and consumers are already facing rising costs in many areas, from food to energy, this bill threatens to further increase prices for everyday goods and services, and exacerbates financial strains already being felt by so many Pennsylvanians.

PA Chamber of Business and Industry position:

OPPOSE

STATUS:

Vote Scheduled in House Energy Committee

H.B. 265, P.N. 210 – Redefining Unemployment Compensation Law

Description

House Bill 265 would grant UC eligibility to various categories of public school employees during the summer months.

Impact on Business

UC is intended to provide temporary wage benefits to workers who have lost their job through no fault of their own as they actively seek new employment. Expanding the law to include new categories of employees who are not unemployed in the traditional sense would fundamentally change the program and dramatically increase costs when Pennsylvania employers already pay some of the highest UC taxes in the country.

PA Chamber of Business and Industry position:

OPPOSE

STATUS:

Vote Scheduled in House Labor & Industry Committee

H.B. 200, P.N. 561 – Paid Leave Entitlement Program

Description

House Bill 200 would establish the Pennsylvania Family and Medical Leave Insurance Program in which all employers and employees would be taxed to fund a statewide system of wage benefits for individuals to take family or sick leave. Eligible employees would generally be entitled to up to 20 weeks per year to care for themselves or 12 weeks per year to care for a family member.

Impact on Business

This legislation would impose billions in taxes on Pennsylvania employers to create a new entitlement program and require employers of all sizes to adopt a one-size-fits-all mandatory policy related to time off regardless of a company’s size, industry, etc. A “private option” included in the bill is so prescriptive and administratively challenging it’s likely most employers will be prohibited from developing customized leave policies that benefit their employees while still accommodating their own unique staffing requirements

PA Chamber of Business and Industry position:

OPPOSE

STATUS:

Vote Scheduled in House Labor & Industry Committee

New Member Highlight- Black Ops Security Services

Black Ops Security Services is a premier security provider based in Berwick, dedicated to safeguarding businesses, events, and individuals with expert protection. Founded on integrity and vigilance, the company offers armed and unarmed security, event security, executive protection, mobile patrols, and crisis response—all delivered by highly trained professionals with law enforcement and military backgrounds. Committed to community safety, Black Ops Security Services partners with local businesses and organizations to create secure environments. Trusted for their professionalism and reliability, they continue to set the standard for excellence in security. To learn more about Black Ops Security Services call (570) 520-4085

Black Ops Security Services is a premier security provider based in Berwick, dedicated to safeguarding businesses, events, and individuals with expert protection. Founded on integrity and vigilance, the company offers armed and unarmed security, event security, executive protection, mobile patrols, and crisis response—all delivered by highly trained professionals with law enforcement and military backgrounds. Committed to community safety, Black Ops Security Services partners with local businesses and organizations to create secure environments. Trusted for their professionalism and reliability, they continue to set the standard for excellence in security. To learn more about Black Ops Security Services call (570) 520-4085

This or That? – New Business Decisions

Source: McKonly & Asbury

Starting a new business is exciting! It is a new venture that follows a passion or dream. Starting a new business also means new responsibilities. With new responsibilities comes many decisions to be made. This can be very daunting and overwhelming for a business owner. How does one know what accounting method they should use for their business, or what type of entity should be selected? What difference does it all make? Throughout this blog article we’ll take a deeper look into the popular game of “This or That?” where new business owners are faced with two options and must choose one. Here goes…

Starting a new business is exciting! It is a new venture that follows a passion or dream. Starting a new business also means new responsibilities. With new responsibilities comes many decisions to be made. This can be very daunting and overwhelming for a business owner. How does one know what accounting method they should use for their business, or what type of entity should be selected? What difference does it all make? Throughout this blog article we’ll take a deeper look into the popular game of “This or That?” where new business owners are faced with two options and must choose one. Here goes…

Accounting Methods

One of the decisions for a new business is to decide what type of accounting method should be used for financial reporting. Accounting methods are primarily distinguished by when revenue and expenses are recognized. The two main accounting methods are accrual-based and cash-based accounting. Accrual-based accounting is often used by larger companies, while smaller businesses and sole proprietors tend to use cash-based accounting.

Accrual-based accounting recognizes revenue when it is earned, rather than received, and expenses when they are made, rather than when they are paid. Since accrual accounting records Accounts Receivable and Accounts Payable, it can provide a more accurate picture of a company’s financial health and profitability. However, by recording revenue that has not yet been received, it can make a company look more profitable than it really is, particularly if cash balances are low. Accrual accounting is more complex, which can be more time-consuming, and often requires additional accounts, such as Deferred Revenue and Prepaids.

On the other hand, cash-based accounting records revenue when payment is deposited into the business, and expenses are recognized when an expense is paid. Since cash-based accounting does not record Accounts Receivable and Accounts Payable, it is simpler to keep records updated and have an accurate picture of cash flow. However, due to the lack of Accounts Payable, it can overstate the health of a company because outstanding vendor invoices, which are additional expenses, are not included in the financial statements. The opposite is also true for Customer Receivables. Here is a helpful article depicting key differences.

Accounting Periods

An accounting period determines a business’s tax year for tax returns. The two tax year types are calendar year and fiscal year. Calendar year is as it sounds, a tax year that runs consecutive with the calendar year, beginning in January and ending in December. By choosing the calendar tax year, a business must report income received and expenses incurred between January 1 and December 31. A fiscal year is a 12-month period that ends on any last day of the month except December 31. If a business elects to use a fiscal year, they will report income and expenses for their selected 12-month time frame. A fiscal year is most common with governments, non-profits, and businesses that have seasonality periods, such as retail companies or resorts.

Business Entity Type

There are several different types of entities that should be compared to determine how an owner wants to structure their business. An owner should also review their state rules and requirements to see what may be most beneficial for their business. It is also helpful and recommended to contact an accounting professional and legal counsel for guidance.

A sole proprietorship is a business owned by only one person. The business income is reported on the personal tax return and the owner pays self-employment tax. The owner may also be liable for business debts.

A partnership is structured similarly to a sole proprietorship. The main difference is that the business is owned by two or more people. If it is a limited partnership, then one partner typically has unlimited liability for business debts, while the remaining partners have limited liability along with limited control. A limited liability partnership takes this one step further by giving limited liability to all partners.

A limited liability company is owned by one or more people. This type of entity provides benefits from a corporation and a partnership. It protects an owner from personal liability, and income is passed through to an owner’s personal return without having to pay corporate taxes. Like the sole proprietorship and partnership, owners must claim the income on their personal tax return and pay self-employment tax.

The C Corp is a corporation and is also owned by one or more people. However, unlike the previously mentioned entity types, income is reported on a corporate tax return rather than being passed to the personal tax return. Corporations are liable for business debts instead of the owners. Corporations can be more expensive to form and require additional financial reporting. There may also be double taxation when dividends are paid to shareholders, which must be claimed as income on personal tax returns.

An S Corp is owned by 100 or less people. In some cases, trusts and estates can be structured as an S Corp. An S Corp is structured like a C Corp, except that there is protection from double taxation. Business profits are passed to the owners and reported on personal income tax returns instead of being taxed as a corporation. States can have their own rules for S Corps, so it is important to review state guidelines.

When starting a new business, there are so many decisions to make. Some are fun and easy, like choosing the business name or what items will be sold. Others, such as business entity structures and accounting methods, can be difficult and confusing. With those types of decisions, a tax advisor or legal counsel can help guide a business owner and simplify the process. For specific questions, assistance, or additional information, please contact Becky Lauffer, a member of our Entrepreneurial Accounting Solutions (EAS) team, to help solve your “This or That?” questions.

Delegation Done Right: Free Yourself and Empower Your Team

- Delegation is a leadership multiplier. Done right, it empowers your team, builds future leaders, and gives you back time to focus on strategy.

- Why it matters: Leaders who master delegation grow faster. Gallup found they generate 33% more revenue than those who don’t delegate effectively.

- Delegation myths hold leaders back: It’s not about losing control or dumping tasks. It’s about creating clarity, trust, and accountability.

- The bottom line: You can’t scale by doing more. You scale by letting go—and empowering your team to step up.

You’re juggling too much—and it’s slowing you down.

615 words ~ 3 min read

Many leaders take pride in wearing all the hats. You built the business. You know how everything works. But the constant “I’ll just do it myself” mindset can quickly lead to burnout—and a team that’s disengaged, underutilized, and uninspired.

Many leaders take pride in wearing all the hats. You built the business. You know how everything works. But the constant “I’ll just do it myself” mindset can quickly lead to burnout—and a team that’s disengaged, underutilized, and uninspired.

Here’s the truth: Delegation isn’t giving up control. It’s multiplying your impact. When done right, delegation empowers your team, develops future leaders, and gives you the space to focus on the work that only you can do: vision, strategy, and growth.

Why Leaders Struggle to Delegate

If you’ve ever thought:

- “No one can do this as well as I can”

- “It’s faster if I do it myself”

- “If something goes wrong, I’m the one on the hook”

You’re not alone. These beliefs are common—but they limit your potential and the potential of your people.

A Gallup study found that leaders who delegate effectively generate 33% more revenue than those who don’t. (Gallup) Delegation isn’t just a time-saver; it’s a growth strategy.

The #1 Leadership Mistake: Doing It All Yourself

When leaders hoard decision-making and execution, they:

- Become the bottleneck

- Burn out

- Create a team culture of dependence instead of ownership

Delegation flips the script. It encourages autonomy, accountability, and initiative—three things every high-performing team needs.

As Harvard Business Review puts it:

"Delegation is not a zero-sum game where one person’s gain is another’s loss. It’s a win-win when approached with clarity and purpose.” (HBR)

Common Delegation Myths—And the Truth Behind Them

- Myth: “I’ll lose control.”

Truth: Clear expectations and regular check-ins keep you informed without micromanaging. - Myth: “Delegation is dumping.”

Truth: Delegation is a leadership skill that builds trust and empowers others to grow. - Myth: “I don’t have time to train someone.”

Truth: Time invested in training upfront pays dividends in productivity and independence later.

The Delegation Playbook: 3 Simple Steps

Step 1: Clarify the Why

Don’t just assign tasks. Provide context. Explain why the task matters and how it ties into bigger goals. People are more engaged when they understand the purpose behind the work.

Step 2: Match Tasks to Strengths (and Stretch Them)

Delegate based on individual skills—but also look for opportunities to develop new ones. Aligning tasks with someone’s career goals creates buy-in and drives personal growth.

Step 3: Define Success, Then Step Back

Be clear about desired outcomes, deadlines, and key metrics. But don’t dictate how the work gets done. Let people problem-solve and take ownership. Check in, but don’t hover.

Pro Tip: Use this delegation script—

“I’d like you to take the lead on [project]. Here’s what success looks like: [clear outcome]. I trust your judgment. Let’s check in at [milestone] to make sure you have what you need.”

What You Gain When You Let Go

When leaders delegate effectively, they:

- Free themselves to focus on strategy, customers, and growth.

- Empower their teams to take ownership, which builds confidence and capability.

- Avoid burnout by shifting from “doer” to “leader.”

You don’t scale by working harder—you scale by working smarter and building a team that grows alongside you.

Takeaway

Delegation isn’t a nice-to-have. It’s a critical leadership skill that drives growth—for you, your team, and your business.

- It builds trust.

- It develops leaders.

- It unlocks time and energy to focus on what matters most.

Let go of the small stuff. Step into your role as the visionary leader your team needs.

---

The Columbia Montour Chamber of Commerce is a private non-profit organization that aims to support the growth and development of local businesses and our regional economy. We strive to create content that not only educates but also fosters a sense of connection and collaboration among our readers. Join us as we explore topics such as economic development, networking opportunities, upcoming events, and success stories from our vibrant community.