President’s Message: Members in a Holding Pattern on Tariffs

by Chris Berleth, President, Columbia Montour Chamber of Commerce

Last week, the Columbia Montour Chamber polled its members to aid federal officials in understanding the real-time impact of tariffs and trade policy on local businesses in Columbia and Montour Counties. Below, you'll find the results of that survey.

Who Answered the Survey?

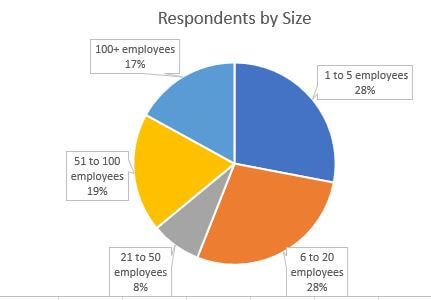

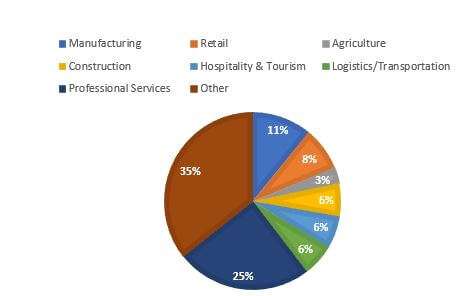

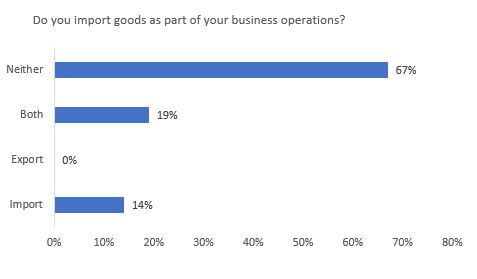

The survey polled Chamber members, was anonymous, and gathered answers across a wide array of industries, including manufacturers, retailers, agriculture, construction, hospitality & tourism, logistics & transportation, professional services, local governments, non-profits, social services organizations, arts, and wholesale distributors. Survey responses were representative of business size in the region and among the Chamber membership as well, as shown by the employee counts of respondents. The majority of survey respondents are not importers or exporters (67%). 19% both import and export goods, and 14% only import goods. 0 respondents only export goods.

Impact on Local Business

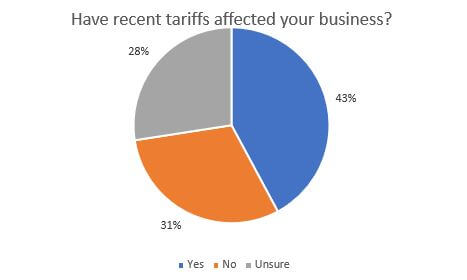

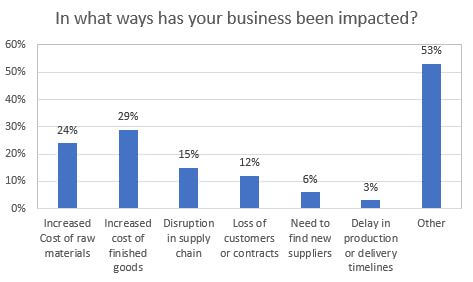

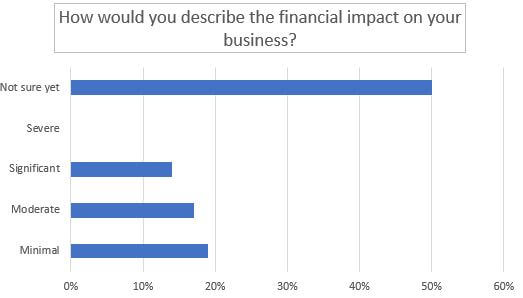

43% of respondents indicated that their businesses had been affected by tariffs, 31% said they were not affected, and 28% were unsure if there was any impact. While respondents could identify with impacts of businesses such as increased cost of raw materials, finished goods, disruption in supply chain, loss of customers, only 6% indicated they needed to find a new supplier, and only 3% reported a delay in production or delivery timelines as a result of tariffs. Overwhelmingly, respondents shared other impacts, which varied by business. Examples given included increased cost of capital expenditures for future/planned investments, impact on their customers, and increased price of competitor products, especially goods produced overseas. 50% of respondents are not yet sure of the financial impact on their business, while 19% reported a minimal impact, 17% reported a moderate impact, and 14% reported a significant impact. 0 respondents indicated a severe financial impact on their business to date.

Local Responses to Tariffs and Trade Policy

Survey results show that 58% of businesses responding have taken no action to date as a result of the impact on their business, while 11% have reported raised prices, 17% sought alternative suppliers, 8% delayed investments or expansions, and 8% reduced staff or hours. 17% of respondents issued alternative impacts, including reviewing budgeted expenses, proactively seeking revenue alternatives, and analyzing logistics for products that may cross back and forth from Mexico and Canada to the U.S. to determine possible future logistics strategies. One respondent reported having already met with federal officials to discuss the direct impact on their business.

Concerns & Conclusion

When asked to rate their level of concern regarding future tariffs or changes to trade policy, 42% of respondents indicated that they were very concerned, 22% reported being somewhat concerned, 19% were not concerned, and 17% were unsure. In summary, most businesses are cautiously watching for the impact of trade policy changes and tariffs and have taken no action to date. Of the action taken, several businesses are reporting increased efforts to communicate changes to pricing, impacts on suppliers, and more.

U.S. Chamber Perspective

In a recent special event for small business owners, U.S. Chamber of Commerce Executive Vice President, Chief Policy Officer, and Head of Strategic Advocacy Neil Bradley and Senior Vice President, Head of International, John Murphy, shared the latest on tariffs and how they are impacting small businesses. The duo broke down trade tariffs, what is tariffed, what is not, and what might happen next.

Bradley explained that these tariffs differ from other previous tariffs. “We’re used to some level of tariffs in history and commerce,” Bradley said. “The tariffs that are being imposed this year fall under the International Emergency Economic Powers Act (IEEPA). The benefit from the administration’s perspective is that it doesn’t require notice or public comment to make changes.”

“In the past, it has taken years to negotiate trade agreements with other countries. It’s very difficult to predict how many could be negotiated in 90 days and when they might take place,” Bradley said. The administration has two options going forward, Bradley said. “They could extend the pause, or they could let the pause expire. It is difficult for us to predict where tariff levels for most countries and most products are going to be in 30, 60, 90 days and beyond.”

Bradley said this uncertainty is creating practical issues for small businesses.

These include:

- Companies are receiving notice that foreign suppliers are suspending the delivery of products.

- Traditional customs bonds no longer covering their imports.

- Existing contracts at a fixed price are suddenly subject to higher tariffs.

- Trying to make decisions about whether it makes sense to change foreign suppliers.

- Supply chain problems if others in your supply chain are depending on foreign suppliers.

Bradley suggests small businesses revisit contracts to determine if there are clauses to allow for changes based on tariffs or other supply chain delays.

Additional Resources

The Columbia Montour Chamber will continue to gather resources and information both from and for our members, and will serve resource center for area businesses. As part of the U.S. Chamber Federation program, all small business members of the Columbia Montour Chamber of Commerce are members of the U.S. Chamber of Commerce, and are eligible to access U.S. Chamber resources, including CO, the U.S. Chamber's online publication, briefings like the one held last week by the U.S. Chamber's Neil Bradley and John Murphy, and more.