Member News ~ April 17, 2025

Empowering Our Community: The Bloomsburg EMS Training Institute

In today’s ever-changing world, emergency preparedness is more crucial than ever, and the Bloomsburg EMS Training Institute (BETI) is helping to fulfill the growing need. Learn more about BETI.

ServPro of Columbia Montour and Sullivan Counties and Sean Black - State Farm Insurance Hosting Lunch and Learn

Join ServPro of Columbia, Montour and Sullivan Counties and Sean Black - State Farm Insurance for a Lunch and Learn on April 30th from 11:00 am - 1:00 pm. The lunch event will help walk you through what to do when your business has an emergency. Learn more and register today.

Foundation’s Youth in Philanthropy Program Awards 2025 Grants

Youth in Philanthropy, a program of the Community Giving Foundation, empowers high school students across the region as they work together to create visible impact in their schools and communities. Learn more.

PA Chamber Hosting Educational Tax Credit Webinar

The PA Chamber is pleased to partner with educational tax credit experts on a free upcoming webinar, “How Businesses Can Utilize Pennsylvania’s Educational Tax Credits.” Join us from 10 a.m. to 11:30 a.m. on Thursday, May 8 for an overview of various educational tax credit programs. Registered today.

The Press Enterprise's Best of the Best Contest is now open for Nominations

The Press Enterprise's annual Best of the Best Contest is now open for nominations. Nominate your business or a Chamber member business you love today!

Bloomsburg Children’s Museum Welcomes New Art Exhibit by Two Local Artists

The Bloomsburg Children’s Museum is pleased to announce a new art show, featuring two local artists: Virginia Dignazio and Shaina Davis. Learn more.

Apply Now for the 2025 Greatest Places to Intern in PA Awards!

Does your organization offer rewarding internship opportunities to the next generation of leaders? If so, you might be one of the “Greatest Places to Intern in PA!” Sponsored by the PA Chamber of Business and Industry. Apply here before April 30th.

The Exchange receives grants from Youth in Philanthropy for the Art Cart

The Exchange gratefully announces that it has received grants from two of the Community Giving Foundation’s Youth in Philanthropy affiliates in support of our Art Cart. Learn more.

Bucknell SBDC hosting National Small Business Week event

Celebrate National Small Business Week with the Bucknell SBDC and the presentation of the Eastern PA Entrepreneurial Success of the Year Award on May 8th. RSVP by April 29th here.

Bloomsburg Rotary Hosting E-Cycling Day May 17th

The Bloomsburg Rotary is hosting an E-Cycling Day on May 17th at rear parking lot of Agape from 10:00 am - 12:00pm. Get a full list of accepted items here and the event is welcome to all!

Harry Mathias appointed to State position

Harry Mathias of Mathias Educational Leadership Consulting has been appointed by the PA Secretary of Education as Chief Recovery Officer for the Steelton-Highspire School District. This position is authorized in State Statute for School Districts deemed to be in Financial Recovery Status. Congratulations Harry!

Northern Columbia Community & Cultural Center hosting Golf Tournament

Join the Northern Columbia Community & Cultural Center for the Richard Kriebel & George Hasay Memorial Golf Tournament on June 14th. Learn more here.

Did You Miss Last Week's Member News? Here's News That's Still Timely

SEDA-COG MPO to host Public Meeting ON Electric Vehicles

The SEDA-Council of Governments Metropolitan Planning Organization (SEDA-COG MPO) is partnering with the Pennsylvania Department of Transportation (PennDOT) to sponsor an Electric Vehicle (EV) Community Charging Station public meeting. The event will happen May 8 from 1 - 3 at the Shamokin-Coal Township Library, 210 E. Independence St. Shamokin. Event free, registration requested: https://bit.ly/scevreg.

Direkt Recovery Bloomsburg Overhauling Scale

Direkt Recovery will be temporarily closing from May 1st - May 5th for a scheduled scale overhaul. During this time they will be open by appointment only to accommodate customers. Call (570) 380-1317 to schedule an appointment.

PA Careerlink Hosting Unemployment Compensation Seminar

Get an overview of claims and determination process, as well as appeal rights at the PA Careerlink's in person Seminar on April 30th. The seminar will be held at The Careerlink's 421 Central Rd., Bloomsburg location from 3:30 - 4:30. Learn how to register for this free seminar here.

Berwick YMCA offers Financial Foundations Workshop

The Good Neighbor Project is proud to offer its Financial Foundations workshop on Wednesday, April 30th, from 6pm – 7pm at the Berwick YMCA. This interactive workshop will guide participants through the basics of budgeting, setting financial goals, and how to properly use credit. If you’re interested in attending, you must contact the Berwick YMCA at (570) 752-5981.

The Women's Center Sponsors Mother's Day Tea and Father's Day Celebration

Learn More here about the Mother's Day Tea and the Father's Day Celebration.

Danville's 39th Spring Fling

The festivities take place on Mill St. from Rt. 11 to Front St.; Lower Mulberry to Ferry St.; and a portion of East and West Mahoning Streets and East and West Market Streets. Saturday, May 3rd from 9am to 4pm. Learn More

Grammy Award-Winning Blues Artist Concludes Weis Center’s Spring Season

The Weis Center will end its spring 2025 season with Grammy Award-winning blues artist Ruthie Foster on Friday, April 25 at 7:30 p.m. in the Weis Center Concert Hall. For more information about this event, contact Lisa Leighton, marketing and outreach director, at 570-577-3727 or by e-mail at lisa.leighton@bucknell.edu.

Registration is Open for Camps at Camp Victory

Camper Registration is now open, and Camp Victory and its partner camps are looking for campers to register for a summer full of unforgettable experiences. Visit campvictory.org/partnergroups for registration information about each camp.

Patsy Cline Musical Saunters onto BTE Mainstage

The biographical musical A Closer Walk With Patsy Cline will run on the Bloomsburg Theatre Ensemble Mainstage from May 1st through 4th. Learn more.

Bloomsburg Children's Museum Announces April Programs

Click Here for more information.

Sean Black State Farm Insurance hosts photo contest

This year's categories are People, Nature, Places, and Miscellaneous. Limit one entry per category. For more information and to submit your photos reach out to stephanie@insureberwick.com by May 16 at 8 p.m. to be considered!

Susquehanna Valley United Way’s Day of Action is back!

On April 25, more than 390 volunteers will roll up their sleeves to support 36 Funded Partners and other local nonprofits—bringing practical, hands-on help to meet real needs in our communities. To learn more, click here.

YOUR PERSPECTIVE MATTERS - Take the Creative Workforce Survey from the Pennsylvania Council on the Arts

Their goal is to better understand the people and jobs that comprise Pennsylvania's creative workforce and creative industries. The survey is anonymous and does not include any questions that involve personally identifying information. Take the survey here.

VOTE NOW- Knoebels Nominated for 3 Awards

USA Today's "10 BEST" Readers' Choice Awards is open NOW! Click here to vote for Knoebels.

- Best Theme Park

- Best Restaurant

- Best Roller Coaster

SBDC Hosts 'Starting A Small Business' Seminar

For more information, click here.

Bloomsburg ArtFest Deadline May 2

The seventeenth ArtFest will occur on Saturday, August 23, 2025, from 10:00 AM to 5:00 PM. ArtFest showcases regional artists' original work, accompanied by local food, live music, and activities. More details here. Read the call for entries.

President’s Message: Members in a Holding Pattern on Tariffs

by Chris Berleth, President, Columbia Montour Chamber of Commerce

Last week, the Columbia Montour Chamber polled its members to aid federal officials in understanding the real-time impact of tariffs and trade policy on local businesses in Columbia and Montour Counties. Below, you'll find the results of that survey.

Who Answered the Survey?

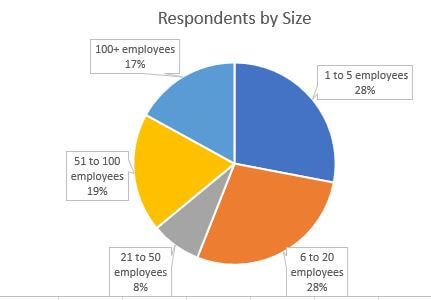

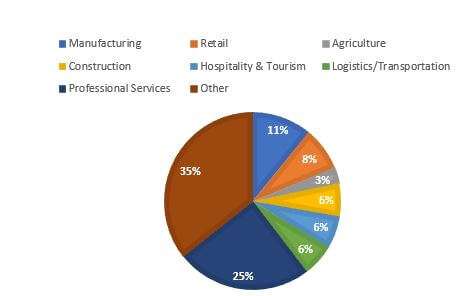

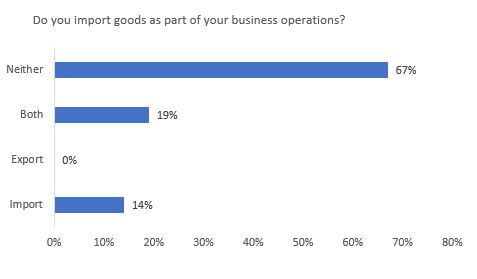

The survey polled Chamber members, was anonymous, and gathered answers across a wide array of industries, including manufacturers, retailers, agriculture, construction, hospitality & tourism, logistics & transportation, professional services, local governments, non-profits, social services organizations, arts, and wholesale distributors. Survey responses were representative of business size in the region and among the Chamber membership as well, as shown by the employee counts of respondents. The majority of survey respondents are not importers or exporters (67%). 19% both import and export goods, and 14% only import goods. 0 respondents only export goods.

Impact on Local Business

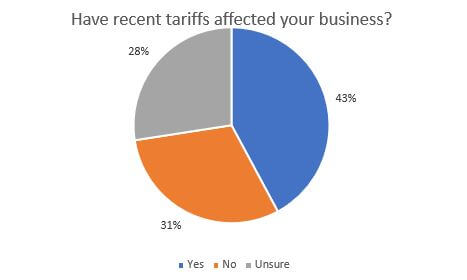

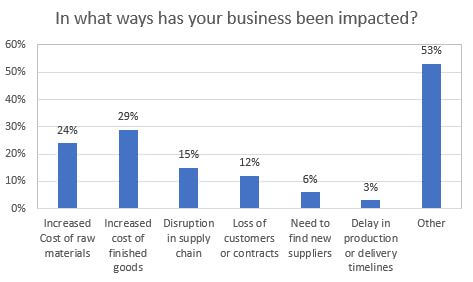

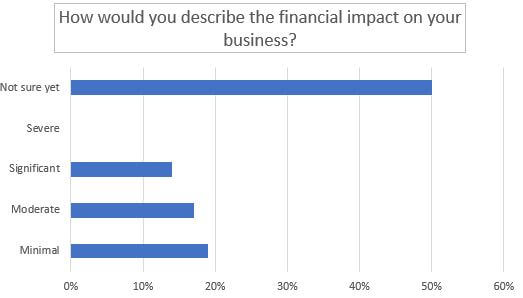

43% of respondents indicated that their businesses had been affected by tariffs, 31% said they were not affected, and 28% were unsure if there was any impact. While respondents could identify with impacts of businesses such as increased cost of raw materials, finished goods, disruption in supply chain, loss of customers, only 6% indicated they needed to find a new supplier, and only 3% reported a delay in production or delivery timelines as a result of tariffs. Overwhelmingly, respondents shared other impacts, which varied by business. Examples given included increased cost of capital expenditures for future/planned investments, impact on their customers, and increased price of competitor products, especially goods produced overseas. 50% of respondents are not yet sure of the financial impact on their business, while 19% reported a minimal impact, 17% reported a moderate impact, and 14% reported a significant impact. 0 respondents indicated a severe financial impact on their business to date.

Local Responses to Tariffs and Trade Policy

Survey results show that 58% of businesses responding have taken no action to date as a result of the impact on their business, while 11% have reported raised prices, 17% sought alternative suppliers, 8% delayed investments or expansions, and 8% reduced staff or hours. 17% of respondents issued alternative impacts, including reviewing budgeted expenses, proactively seeking revenue alternatives, and analyzing logistics for products that may cross back and forth from Mexico and Canada to the U.S. to determine possible future logistics strategies. One respondent reported having already met with federal officials to discuss the direct impact on their business.

Concerns & Conclusion

When asked to rate their level of concern regarding future tariffs or changes to trade policy, 42% of respondents indicated that they were very concerned, 22% reported being somewhat concerned, 19% were not concerned, and 17% were unsure. In summary, most businesses are cautiously watching for the impact of trade policy changes and tariffs and have taken no action to date. Of the action taken, several businesses are reporting increased efforts to communicate changes to pricing, impacts on suppliers, and more.

U.S. Chamber Perspective

In a recent special event for small business owners, U.S. Chamber of Commerce Executive Vice President, Chief Policy Officer, and Head of Strategic Advocacy Neil Bradley and Senior Vice President, Head of International, John Murphy, shared the latest on tariffs and how they are impacting small businesses. The duo broke down trade tariffs, what is tariffed, what is not, and what might happen next.

Bradley explained that these tariffs differ from other previous tariffs. “We’re used to some level of tariffs in history and commerce,” Bradley said. “The tariffs that are being imposed this year fall under the International Emergency Economic Powers Act (IEEPA). The benefit from the administration’s perspective is that it doesn’t require notice or public comment to make changes.”

“In the past, it has taken years to negotiate trade agreements with other countries. It’s very difficult to predict how many could be negotiated in 90 days and when they might take place,” Bradley said. The administration has two options going forward, Bradley said. “They could extend the pause, or they could let the pause expire. It is difficult for us to predict where tariff levels for most countries and most products are going to be in 30, 60, 90 days and beyond.”

Bradley said this uncertainty is creating practical issues for small businesses.

These include:

- Companies are receiving notice that foreign suppliers are suspending the delivery of products.

- Traditional customs bonds no longer covering their imports.

- Existing contracts at a fixed price are suddenly subject to higher tariffs.

- Trying to make decisions about whether it makes sense to change foreign suppliers.

- Supply chain problems if others in your supply chain are depending on foreign suppliers.

Bradley suggests small businesses revisit contracts to determine if there are clauses to allow for changes based on tariffs or other supply chain delays.

Additional Resources

The Columbia Montour Chamber will continue to gather resources and information both from and for our members, and will serve resource center for area businesses. As part of the U.S. Chamber Federation program, all small business members of the Columbia Montour Chamber of Commerce are members of the U.S. Chamber of Commerce, and are eligible to access U.S. Chamber resources, including CO, the U.S. Chamber's online publication, briefings like the one held last week by the U.S. Chamber's Neil Bradley and John Murphy, and more.

Financial Resilience for Nonprofits: Navigating Uncertain Times

Source: McKonly & Asbury

Given the present uncertainty that is a reality for many nonprofits, particularly with the fluctuations in federal funding, it is important to consider the factors that allow an organization to continue fulfilling their mission regardless of the economic or political environment. To establish a sustainable organization, nonprofits must prioritize building and maintaining adequate reserves. Whether it be COVID-19, a new administration in the White House, or whatever may come next, nonprofits should proactively develop strategies for navigating adverse conditions. As the saying goes, they must be “hopeful for the best but prepared for the worst.”

Given the present uncertainty that is a reality for many nonprofits, particularly with the fluctuations in federal funding, it is important to consider the factors that allow an organization to continue fulfilling their mission regardless of the economic or political environment. To establish a sustainable organization, nonprofits must prioritize building and maintaining adequate reserves. Whether it be COVID-19, a new administration in the White House, or whatever may come next, nonprofits should proactively develop strategies for navigating adverse conditions. As the saying goes, they must be “hopeful for the best but prepared for the worst.”

The Importance of Reserves for Nonprofits

Reserves serve as a financial safety net when organizations experience funding shortfalls, economic downturns, and unforeseen expenses. Without sufficient reserves, organizations may struggle to pay their employees, cover operational expenses, or continue fulfilling their mission. In addition to creating a safety net for adverse conditions, strong reserves signal financial health to donors, grantors, and other partners, fostering trust and confidence in the organization’s long-term sustainability.

Here are four strategies nonprofit organizations can take to strengthen reserves and improve financial sustainability.

1. Establish Operating Reserve

Establishing an operating reserve should be a priority for every nonprofit organization. These funds should be liquid and accessible for covering unplanned expenses and neutralizing the effect of budget deficits. According to PANO’s Standards for Excellence #9 Sustainability and Sustainability Planning, “Organizations without a sufficient operating reserve are inherently focused more on the short-term challenges and crisis-based decisions and will become distracted from sustainably accomplishing its mission.” While benchmarks vary, experts often recommend three to six months’ worth of operating expenses in unrestricted reserves. However, organizations with higher reliance on government grants may need to maintain closer to nine to twelve months of expenses in reserves.

2. Fund Depreciation

Funding depreciation consists of funding the operating reserve in amounts equal to the depreciation recognized on an asset each year. If depreciation is budgeted correctly, the asset will have zero value at the end of its useful life. If the organization funds depreciation, it will have sufficient cash in reserves to replace the asset with one of equal value. These depreciation-matching deposits into the operating reserve will directly build future value for the organization.

3. Diversify Funding Streams

Relying too heavily on a single funding source or demographic increases financial risk. While it is important to analyze donor data and create more targeted campaigns, nonprofits should consider expanding revenue through grants, corporate sponsorships, and earned income strategies to create a more stable financial foundation.

4. Invest Wisely

Nonprofits should consider low-risk investment strategies that align with their liquidity needs while allowing reserves to grow over time. For additional information related to nonprofit investment strategy, check out the webinar conversation with Courtney Dean, Nonprofit Investment Advisor from eCIO, “Investing for Success as a Nonprofit Organization.”

Strengthening Financial Resilience in an Uncertain Future

With uncertainty abounding, nonprofits must be proactive about building a plan for sustainability. Nonprofit organizations often have inspiring missions consisting of a grand vision for a better world. Nevertheless, it could all quickly come to a halt if they fail to establish and maintain adequate reserves. By implementing sound financial strategies, nonprofits can build resilience and thrive, even in the midst of challenging times, freeing them up to accomplish their mission and serve their communities.

If you have questions about the information outlined above, please reach out to a member of our Nonprofit team. You can also learn more about our nonprofit services by visiting our Nonprofit industry page.

The post Financial Resilience for Nonprofits: Navigating Uncertain Times appeared first on McKonly & Asbury.

House Passes Budget Plan, Paving Way for Extension of 2017 Tax Cuts

Source: PA Chamber of Business and Industry

The U.S. House of Representatives last week adopted a budget resolution that clears a procedural path for extending key provisions of the 2017 Tax Cuts and Jobs Act.

The U.S. House of Representatives last week adopted a budget resolution that clears a procedural path for extending key provisions of the 2017 Tax Cuts and Jobs Act.

The 216-214 vote last Thursday follows Senate passage and allows Republicans to advance tax reform legislation later this year without needing Democratic support in the Senate.

The resolution allows for up to $5.3 trillion in tax relief and includes a $5 trillion increase to the federal debt limit. It also calls for at least $4 billion in spending cuts and authorizes increased investments in defense and immigration enforcement.

House Speaker Mike Johnson said the vote sends a “very strong signal” to job creators, entrepreneurs, and the broader economy. President Donald Trump also praised it as a major step toward preserving one of his signature first-term policy achievements.

The PA Chamber strongly supports extending the 2017 tax provisions, which reduced tax rates for individuals and businesses, increased the standard deduction, and enhanced expensing for capital investments.

Making these provisions permanent is a key priority for promoting long-term economic growth and competitiveness in Pennsylvania.

Founded in 1916, the Pennsylvania Chamber of Business and Industry is the state's largest broad-based business association, with its membership comprising businesses of all sizes and across all industry sectors. The PA Chamber is The Statewide Voice of BusinessTM.

Employee Benefit Surveys Can Aid Management Understand Employee Realities

Companies today recognize that the business environment is very competitive, and that attracting and retaining top talent requires more than offering a competitive salary. Employee benefits play a critical role in shaping workplace satisfaction, enhancing productivity, and fostering loyalty.

Companies today recognize that the business environment is very competitive, and that attracting and retaining top talent requires more than offering a competitive salary. Employee benefits play a critical role in shaping workplace satisfaction, enhancing productivity, and fostering loyalty.

However, the effectiveness of a benefits program largely depends on whether it aligns with employees’ actual needs and preferences. Conducting employee benefit surveys is one of the most effective tools for organizations to achieve this alignment. These surveys provide invaluable insights into employees’ priorities, allowing companies to make data driven decisions that improve both workforce satisfaction and organizational performance.

Employee benefit surveys serve several critical purposes. They bridge the gap between management assumptions and employee realities. Often, leadership teams implement benefits based on trends or generic benchmarks rather than the specific needs of their workforce. This misalignment can lead to underutilized programs and wasted resources. For instance, an organization may invest heavily in gym memberships while employees express greater interest in childcare support or mental health resources. A well-conducted survey illuminates these disparities, providing clarity on which benefits employees value most and which are less impactful.

Moreover, these surveys demonstrate an organization’s commitment to listening and responding to its employees. When employees feel that their options are valued, it fosters trust and strengthens workplace morale. The very act of asking for feedback sends a powerful message: that the organization values employee well-being and is willing to adapt to better meet their needs. This sense of inclusion can lead to increased engagement, higher job satisfaction, and stronger loyalty to the company.

The Columbia-Montour Chamber of Commerce offers its members access to My Benefit Advisor as a solution for employee benefits, including voluntary offerings. For more information about My Benefit Advisor, visit our website at cmcc.mybenefitadvisor.com or contact Rob Higginbotham at (800) 377-3536.

AI Isn’t Replacing SEO—It’s Redefining It

Google's AI-generated search summaries shift SEO from rankings to relevance.

- Local businesses must prioritize clarity, context, and authority in their content.

- Structured data, featured snippets, and site experience now influence AI visibility.

- Building topical depth helps businesses become the trusted source AI turns to.

- Winning SEO in 2025 means answering questions—not just attracting clicks.

581 words ~ 3 min read

The SEO landscape is changing—and fast. But contrary to what you may have heard, SEO isn’t dead. It’s getting smarter, thanks to AI.

Google’s Search Generative Experience (SGE) is a prime example. Instead of simply listing websites, Google now displays AI-generated summaries in response to user queries. These summaries pull from what the algorithm sees as the most trustworthy and relevant content—and that means your business needs to think differently about how it shows up online.

Google’s Search Generative Experience (SGE) is a prime example. Instead of simply listing websites, Google now displays AI-generated summaries in response to user queries. These summaries pull from what the algorithm sees as the most trustworthy and relevant content—and that means your business needs to think differently about how it shows up online.

This evolution is especially important for local businesses. A potential customer may never scroll down to your link if Google’s AI answers their question up top. But if your content is included in that summary? You’re not just visible—you’re the answer.

What’s Changing?

Traditional SEO focused on keywords, backlinks, and meta tags. Today, search engines use AI to understand intent, not just terms. That means creating human-first content that clearly answers questions, reflects authority, and builds trust.

Instead of writing for algorithms, businesses now need to write for clarity. AI doesn’t reward keyword stuffing—it elevates content that solves problems.

Think of it this way: SEO used to be about getting found. Now, it’s about being useful.

Case in Point

A local HVAC company in Texas revamped its FAQ and service pages to clearly address customer pain points like “Why is my AC leaking?” and “How fast can you repair an AC unit in summer?” They added schema markup and structured headers.

Within weeks, their content began appearing in AI-generated summaries. Bookings rose 22%—and their brand authority grew along with it.

Your AI-Ready SEO Checklist

Here are four moves your business can make today:

-

Optimize for Featured Snippets

Structure your content to answer common customer questions clearly and concisely. Use headers, lists, and direct answers. -

Build Topical Authority

Group your content into clusters—blogs, FAQs, videos—that cover a topic deeply. This signals to AI that your site is a credible source. -

Enhance User Experience

Fast load times, mobile optimization, and easy navigation aren’t just good UX—they’re now ranking signals. -

Use Structured Data (Schema Markup)

Help search engines understand your content. Schema tags tell AI what your page is about—and how it fits user intent.

Why This Matters for Your Business

AI is changing the way customers find and choose businesses. If your content isn’t being surfaced in AI summaries, you risk losing visibility—even if your site ranks on page one.

But this isn’t a threat. It’s an opportunity. Businesses that provide clear, trustworthy answers to common questions will not only stay visible—they’ll become the go-to experts in their space.

And for Chamber members, this shift is a competitive edge. Most small businesses aren’t yet adapting to AI-driven search. By moving early, you stand out.

What to Do Now

✅ Review your website’s top-performing pages.

✅ Ask: Do they clearly answer your customers’ most common questions?

✅ If not, update them with clarity, structure, and supporting content.

✅ Add schema markup where possible.

✅ Improve mobile speed and user experience

SEO isn’t just about being found. It’s about being trusted. In the AI era, businesses that earn that trust—through clear, quality content—will lead the way.

---

The Columbia Montour Chamber of Commerce is a private non-profit organization that aims to support the growth and development of local businesses and our regional economy. We strive to create content that not only educates but also fosters a sense of connection and collaboration among our readers. Join us as we explore topics such as economic development, networking opportunities, upcoming events, and success stories from our vibrant community. Our resources provide insights, advice, and news that are relevant to business owners, entrepreneurs, and community members alike.

Member News ~ April 10, 2025

PA Careerlink Hosting Unemployment Compensation Seminar

Get an overview of claims and determination process, as well as appeal rights at the PA Careerlink's in person Seminar on April 30th. The seminar will be held at The Careerlink's 421 Central Rd., Bloomsburg location from 3:30 - 4:30. Learn how to register for this free seminar here.

Service 1st Announces Johnson as Chief Lending Officer

Service 1st Federal Credit Union recently announced the promotion of Brett Johnson to Chief Lending Officer. Learn more.

Hinerfeld Commercial Real Estate's Shannon Trivett Earns Designation

Hinerfeld Commercial Real Estate proudly announces that Shannon Trivett has been awarded the Certified Property Manager (CPM®) designation by the Institute of Real Estate Management (IREM). Learn more.

Direkt Recovery Bloomsburg Overhauling Scale

Direkt Recovery will be temporarily closing from May 1st - May 5th for a scheduled scale overhaul. During this time they will be open by appointment only to accommodate customers. Call (570) 380-1317 to schedule an appointment.

SEDA-COG MPO to host Public Meeting ON Electric Vehicles

The SEDA-Council of Governments Metropolitan Planning Organization (SEDA-COG MPO) is partnering with the Pennsylvania Department of Transportation (PennDOT) to sponsor an Electric Vehicle (EV) Community Charging Station public meeting. The event will happen May 8 from 1 - 3 at the Shamokin-Coal Township Library, 210 E. Independence St. Shamokin. Event free, registration requested: https://bit.ly/scevreg.

Individual Chamber Member Announces Candidacy for Mayor

Mark Gardner, an individual Chamber member, and a 25-year resident of Bloomsburg, has announced his candidacy for Mayor of Bloomsburg. Read his full press release here.

The Women's Center Sponsors Mother's Day Tea and Father's Day Celebration

Learn More here about the Mother's Day Tea and the Father's Day Celebration.

Registration is Open for Camps at Camp Victory

Camper Registration is now open, and Camp Victory and its partner camps are looking for campers to register for a summer full of unforgettable experiences. Visit campvictory.org/partnergroups for registration information about each camp.

Patsy Cline Musical Saunters onto BTE Mainstage

The biographical musical A Closer Walk With Patsy Cline will run on the Bloomsburg Theatre Ensemble Mainstage from May 1st through 4th. Learn more.

Did You Miss Last Week's Member News? Here's News That's Still Timely

Berwick YMCA offers Financial Foundations Workshop

The Good Neighbor Project is proud to offer its Financial Foundations workshop on Wednesday, April 30th, from 6pm – 7pm at the Berwick YMCA. This interactive workshop will guide participants through the basics of budgeting, setting financial goals, and how to properly use credit. If you’re interested in attending, you must contact the Berwick YMCA at (570) 752-5981.

Danville's 39th Spring Fling

The festivities take place on Mill St. from Rt. 11 to Front St.; Lower Mulberry to Ferry St.; and a portion of East and West Mahoning Streets and East and West Market Streets. Saturday, May 3rd from 9am to 4pm. Learn More

Bloomsburg Children’s Museum Hosts 9th Annual High School Art Show

The Bloomsburg Children’s Art Museum proudly hosted the opening reception for its highly anticipated 9th Annual High School Art Show on Friday, March 28, 2025, showcasing the incredible creativity and talent of young artists in the community. The work will be on display at the museum until April 19, 2025. To read the full article, click here.

Grammy Award-Winning Blues Artist Concludes Weis Center’s Spring Season

The Weis Center will end its spring 2025 season with Grammy Award-winning blues artist Ruthie Foster on Friday, April 25 at 7:30 p.m. in the Weis Center Concert Hall. For more information about this event, contact Lisa Leighton, marketing and outreach director, at 570-577-3727 or by e-mail at lisa.leighton@bucknell.edu.

Bloomsburg Children's Museum Announces April Programs

Click Here for more information.

Sean Black State Farm Insurance hosts photo contest

This year's categories are People, Nature, Places, and Miscellaneous. Limit one entry per category. For more information and to submit your photos reach out to stephanie@insureberwick.com by May 16 at 8 p.m. to be considered!

Senator Lynda Culver hosts Free License Plate Exchange

Visit the Montour Township Police Department on April 11th from 11am-1pm to receive a new license plate. All paperwork and services are 100% free. Learn More

Susquehanna Valley United Way’s Day of Action is back!

On April 25, more than 390 volunteers will roll up their sleeves to support 36 Funded Partners and other local nonprofits—bringing practical, hands-on help to meet real needs in our communities. To learn more, click here.

YOUR PERSPECTIVE MATTERS - Take the Creative Workforce Survey from the Pennsylvania Council on the Arts

Their goal is to better understand the people and jobs that comprise Pennsylvania's creative workforce and creative industries. The survey is anonymous and does not include any questions that involve personally identifying information. Take the survey here.

VOTE NOW- Knoebels Nominated for 3 Awards

USA Today's "10 BEST" Readers' Choice Awards is open NOW! Click here to vote for Knoebels.

- Best Theme Park

- Best Restaurant

- Best Roller Coaster

SBDC Hosts 'Starting A Small Business' Seminar

For more information, click here.

Bloomsburg Rotary's Annual Peanut Butter and Jelly Drive is happening now

Join the Bloomsburg Rotary in their annual Peanut Butter and Jelly Drive. Find a drop-off location here. The drive runs now through April 18th. They have a goal of collecting 2,025 pounds of peanut butter and jelly! Monetary donations can be made to the club to purchase PNB and Jelly by mailing contributions to P.O. Box 842, Bloomsburg,PA,17815

Women's Giving Circle will hold next "On the Bright Side" April 17th

Join the Women's Giving Circle on April 17th at noon for our next "On the Bright Side" virtual session. Led by presenters Cynthia Schroll and Sally Meyer, both avid gardeners and members of the Fishing Creek Herb Guild, we'll look at the many benefits of including native plants and herbs in your gardening plans for this season. Register here.

Bloomsburg ArtFest Deadline May 2

The seventeenth ArtFest will occur on Saturday, August 23, 2025, from 10:00 AM to 5:00 PM. ArtFest showcases regional artists' original work, accompanied by local food, live music, and activities. More details here. Read the call for entries.

President’s Message: Travel with Your Chamber

In our recent Chamber member survey, we asked, “What’s your favorite part of your Chamber membership?” The answer was overwhelmingly one-sided: respondents said, “Naisc ghnó”.

In our recent Chamber member survey, we asked, “What’s your favorite part of your Chamber membership?” The answer was overwhelmingly one-sided: respondents said, “Naisc ghnó”.

Well, sort of.

“Naisc ghnó” is the Irish-gaelic translation of the answer we got, which is “connections”, and now you’re probably wondering, “Chris, why are you speaking Gaelic?”

I’m excited to share that the Chamber is taking a little trip to Ireland in March of 2026, and you’re invited!

For several years, we’ve heard that Chambers across Pennsylvania offer their communities an opportunity to travel internationally via Chamber facilitated group trips. We did a little research, and we were surprised to find that there isn’t anything like that nearby. So here’s the plan:

With our partner and newest Chamber member, Collette (of Wheel of Fortune fame), which is a family-owned business that’s been offering 100 years of travel excursions, the Columbia Montour Chamber will host a 10-day trip called “Shades of Ireland” from March 16 to March 25, 2026. We’re pulling out all the stops to make this trip affordable, convenient, fun, and engaging for any community member.

Our itinerary includes thirteen meals, four-star hotels (and a castle or two), and a healthy mix of expert-led tours and opportunities to adventure on one’s own across the incredible sights – Dublin on St. Patrick’s Day, Waterford and the Crystal Factory, the Blarney Stone, the Cliffs of Moher, and Limeric, to name a few. We’re proud to help make traveling easy, departing as a group from Bloomsburg to Newark, and across the Atlantic, providing informational sessions, and giving you a chance to make new friends, or travel with “seanchairde” (old friends). We expect unparalleled sightseeing, comfortable on-tour transportation, and hotel-to-hotel baggage handling,.

To learn more about our “Shades of Ireland” trip, check out our website, or sign up for a June 11 informational meeting where we’ll go over all of the details. Adventurers need not be members of the Chamber to travel with us, and all are invited to learn more.

Financial Literacy in the Susquehanna Valley: Empowering Students Through Real-World Learning

The Foundation of the Columbia Montour Chamber is proud to partner with Journey Bank to launch Financial Literacy in the Susquehanna Valley, a new program designed to equip students with essential personal finance skills. This initiative reflects a shared commitment to preparing the next generation for financial independence and long-term success.

The Foundation of the Columbia Montour Chamber is proud to partner with Journey Bank to launch Financial Literacy in the Susquehanna Valley, a new program designed to equip students with essential personal finance skills. This initiative reflects a shared commitment to preparing the next generation for financial independence and long-term success.

Through a collaboration with Brighter Financial Futures, the program brings the Personal Finance Lab simulation into classrooms across the Columbia Montour region. The interactive platform allows students to manage virtual budgets, make investment decisions, and experience real-world financial scenarios—giving them the opportunity to apply financial concepts through practical, engaging simulations that translate into meaningful, hands-on learning experiences that help prepare them for life beyond the classroom.

With Journey Bank’s generous sponsorship, area schools can access this valuable tool at no cost by enrolling in the program—helping more students gain essential financial skills through high-quality, real-world learning.

Financial Literacy in the Susquehanna Valley is part of the Foundation’s broader mission to connect education with opportunity, helping students develop the knowledge and confidence needed to make informed decisions about money, careers, and their future.

Tariff Survey: Tell Us the Good, the Bad, the Certain, and the Uncertain

Your Chamber is committed to representing your interests as we continue to advocate at the local, county, state, and federal level. Recently, members of our federal delegation sought input from the Chamber about the real-time impacts of trade policy, including tariffs, and asked what we know. While we have shared several anecdotes (with both pain points and positive experiences), we’d love for your feedback to serve as real data. We want to know it all – good, bad, indifferent, and uncertain.

Your Chamber is committed to representing your interests as we continue to advocate at the local, county, state, and federal level. Recently, members of our federal delegation sought input from the Chamber about the real-time impacts of trade policy, including tariffs, and asked what we know. While we have shared several anecdotes (with both pain points and positive experiences), we’d love for your feedback to serve as real data. We want to know it all – good, bad, indifferent, and uncertain.

Please consider taking a moment to complete this 10-question survey. We hope to hear from all of our members and their various industries, and invite you to also share additional details via email if they do not fit in the comments section of the survey itself.

Please consider taking a moment to complete this 10-question survey. We hope to hear from all of our members and their various industries, and invite you to also share additional details via email if they do not fit in the comments section of the survey itself.

Examples of helpful recent comments include those by a local supply house, who shared a website they’d set up to keep customers apprised of anticipated cost increases. Another member shared about the specific types of goods that are being impacted in their storefront, compared to others. A wood-products manufacturer shared about an uptick in sales for their American-made product line. Comments like these help us paint a more complete picture.

Thanks for your consideration!