Member News – November 16, 2022

Bloomsburg Town Council Hires Administrative Finance Receptionist

Congratulations to Kyleigh Bilger, a recent communications studies graduate from Bloomsburg University. Recently, Kyleigh interned as a media and Communications specialist with the Susquehanna Greenways Partnership.

FREAS FARM WINERY TO HOST CUSTOMER APPRECIATION DAYS

Visit Freas Farm Winery November 19 - 20, as they thank customers with special treats and a holiday gift basket drawing.

Prepare for Winter Heating Season with Energy Efficiency Measures

PPL is encouraging these Energy Smart tips to lower costs this winter. Read more.

Brookdale Senior Living Earns J.D. Power Award for 2022

Congratulations to Brookdale Senior Living for ranking #1 in the 2022 U.S. Senior Living Satisfaction Study for Assisted Living/Memory Care. The Study surveys family members’ and decision-makers’ satisfaction with their loved one’s senior living community. Read more.

It's Community Foundation Week!

The Community Giving Foundation is celebrating stories from donors, nonprofits, board members and community partners during Community Foundation Week (November 12 - 18). For two more days, community members are invited to take a selfie in the social media contest with the hashtag #CommunityFNDWeek. Use the selfie to express what community giving means to you, and win a chance at a special t-shirt. Learn more here.

The Community Giving Foundation is celebrating stories from donors, nonprofits, board members and community partners during Community Foundation Week (November 12 - 18). For two more days, community members are invited to take a selfie in the social media contest with the hashtag #CommunityFNDWeek. Use the selfie to express what community giving means to you, and win a chance at a special t-shirt. Learn more here.

Hand in Hand Family Resource Center to Host Sensory Santa

Sensory Santa is an opportunity for children (of all ages) to experience Santa in a quiet and welcoming, sensory-friendly environment. This year, Hand in Hand Family Resource Center will host events in Berwick (12/3), Bloomsburg (12/11), Benton (12/18), and Danville (12/18). Traveling Santa visits children that are unable to attend our events due to medical or extreme sensory needs. Each visit with Santa is private for the family and is child-led - Santa will sit at a distance or get down on the floor and play. Santa also brings each child and their siblings a gift that is hand picked just for them. See the flyer for more.

Thrivent to Host Seasonal Event & Informational Session for Local Charities

Thrivent invites community members to enjoy food and friendship for a good cause at an event they're hosting at the Pine Barn Inn on Sunday, December 18, from 1pm to 5pm. Event will feature hors d'ouevres, seasonal beverages, a carving station, and more for all guests. Guests will enjoy a brief informational session for the Animal Resource Center, the Janet Weis Children's Hospital, and the the Jared Box Project. RSVP by November 22 by calling 570-317-2111 or by emailing IronGuideGroup@thrivent.com.

Upper Augusta Flood Mitigation Project Receives Funding

With help from the offices of Senator John Gordner and Representative Lynda Schlegel-Culver, Upper Augusta Township received a $468,890 Flood Mitigation grant from the Commonwealth Financing Authority to address flash flooding. Read more.

T-Ross Brothers to Host Holiday Open House November 30

Chamber members are invited to attend. See the flyer here.

It's the Holiday Season...and We're Your Clearinghouse for Community Events

Berwick

- 11/24 -10:00am - Run for the Diamonds

- 11/25 - 10:30am - Santa Parade

- 11/26 - Speedo Run For the Cause

- 12/3 - Christmas Boulevard opens daily through December, 6pm - 10pm

- 12/10 - 5:00pm - Winterfest in downtown Berwick

Bloomsburg

- 11/25 - 4:00pm - TreeFest begins at the Caldwell Consistory

- 11/25 - 4:30pm - Parade of Lights - forms in Geisinger Bloomsburg Lot, moves at 6pm; Lighstreet Rd to Main St., Market to 5th, 5th to Fairgrounds. Register here.

- 11/25 & 11/26 - 10:00am - 8:00pm - Winterfest at the Fairgrounds - (Free) - Shop over 150 craft vendors inside the fair buildings including local wineries and breweries.

- 11/26 - Santa begins hours at Exclusively You on the square. Schedule here.

- 11/26 & 11/27 - North Pole Express Train Rides - Rides are approximately 1 hour and travel from Bloomsburg at Autoneum to Catawissa. Ticket availability here. Tickets for 10am Saturday ride are sold out. Tickets can also be purchased at Exclusively You, The Exchange, and Town Camera.

- 12/2 - Coming Home for Christmas/Tree Lighting - Tree lighting at 5:30pm in front of the Bloom Diner. Coming Home for Christmas to be held outside the Caldwell Consistory.

- 12/2, 12/3, 12/9, and 12/10 - Santa visits Renco Ace Hardware! Photos are free, but Renco is requesting consideration - that customers bring a nonperishable food item or monetary gift for AGAPE's Food Bank.

Danville

- 11/19 - 9am - 7:00pm - Scott's Floral to host Holiday Open House

- 11/19 - Free Wagon Rides - 4pm - 7pm - Take a break from the hustle and bustle with a relaxing horse-drawn wagon ride from Lower Mulberry Street.

- 12/3 - Hometown Holiday Market - 11am - 4pm - Festive street fair featuring holiday shopping, entertainment, and activities on Mill Street.

- Wagon Rides are sold out for 12/3, 12/10, and 12/11.

Riverside

- The Boro of Riverside will host its 2nd Annual Parade of Lights on 12/3. Parade forms at 4pm at former Riverside Elementary School. $50 prizes will be awarded in four categories - walkers/marching, vehicles without floats, large floats (over 20 feet), and small floats (under 20 feet). Santa in the Park will be located under the park pavilion. Registration due by November 30 to the Riverside Boro.

Joy Through the Grove

- 11/25 - 12/31 - (Except for Christmas Eve and Christmas Day) 5:30pm - 9:00pm. Learn more.

UGI URGES ELIGIBLE CUSTOMERS TO APPLY FOR LIHEAP

UGI encourages eligible natural gas and electric customers to apply for the federal Low Income Home Energy Assistance Program (LIHEAP) funds to help cover the cost of heating their home this winter. Applications will be accepted by the Pennsylvania Department of Human Services beginning November 1, 2022.

HOME IMPROVEMENT TIP FROM LARRY'S LUMBER!

Check out the latest blog post from Larry's Lumber, which regularly features cost-saving recommendations to keep your homes (and your employees homes) in good condition.

Bloomsburg Passes Noise Ordinance

On Monday, November 14, Bloomsburg Town Council enacted amendments to its noise ordinance which prohibit sustained noises above 65 decibels between 7 a.m. and 10 p.m. and below 50 from 10 p.m. until 7 a.m. Any sound must be officially measured for more than 10 minutes cumulatively in an hour to be in violation. Fines for violating the ordinance range from $1,000-$2,000 and the possibility of jail time or injunctions for repeat offenses.

On Monday, November 14, Bloomsburg Town Council enacted amendments to its noise ordinance which prohibit sustained noises above 65 decibels between 7 a.m. and 10 p.m. and below 50 from 10 p.m. until 7 a.m. Any sound must be officially measured for more than 10 minutes cumulatively in an hour to be in violation. Fines for violating the ordinance range from $1,000-$2,000 and the possibility of jail time or injunctions for repeat offenses.

The impetus for revising the existing ordinance was concerns raised by Town residents about sound levels from auto racing at the Bloomsburg Fairgrounds. Council has been considering revisions to the ordinance since mid-2021 and The Chamber has repeatedly called for scientifically-based noise limits and compromises that benefit the entire community.

During public discussion at the meeting, Chamber President Fred Gaffney gave the following statement:

"I am here this evening to express The Columbia Montour Chamber of Commerce’s strong opposition to the proposed noise ordinance. As stated during your last meeting on October 24th, and during your workshop on November 7th, this version would result in unintended consequences. Your goal of protecting the physical health of Town residents is certainly appropriate. The 65-decibel limit recommended by your consultant has cited a document from the World Health Organization titled Guidelines for Community Noise. In that document, 65 decibels is not a threshold for protecting physical health, but rather to allow clear conversation in close proximity. Section 3 of that document, Adverse Health Effects of Noise, states, “hearing impairment is not expected to occur at levels of 75 dBa or below, even for prolonged occupational noise exposure.”

As we’ve stated previously, OSHA sets a threshold of 85 dBa over a prolonged period of time in requiring hearing protection in an industrial setting. Jeffrey Ritter is a Compliance Assistance Specialist with OSHA’s Wilkes-Barre Area Office. He noted to me in a phone conversation on October 25th that while that threshold has not been updated in 30 years, it is based on scientific data and agreement.

Even if the level is increased, this ordinance provides for acceptable forms of damaging noise, including Town-approved activities including the 4th of July fireworks and Town Park Concert Series. How is it appropriate that the Town would be able to sanction forms of damaging noise, while completely prohibiting others? Also, this version does not make clear the full scope of exempt activities, such as routine lawn maintenance with gas-powered lawnmowers and leaf blowers.

With these issues, it appears likely the ordinance will be challenged, resulting in legal costs for the Town. This will divert financial resources from areas and potential projects that could be used to further enhance the Town and/or result in a tax increase.

We again urge you to not pass the current version of the ordinance and revise the noise limit to one that is scientifically based. As the ordinance allows the noise limit to be exceeded, fair and reasonable accommodation should be provided to other parties without prejudice. Finally, the ordinance should more clearly define exempt and non-exempt forms of noise, as well as the criteria for Town approval of activities."

Following the vote, Gaffney offered the following statement:

"We are hopeful that Council will refine this ordinance over time to address the concerns we've raised."

Welcome New Member – ZenBusiness

The Columbia Montour Chamber is pleased to welcome to its membership ZenBusiness.

ZenBusiness makes it easy to start, run, and grow your business. They are a small business that is excited about helping other entrepreneurs realize their dreams of creating and growing a successful business. By making business formation easy and affordable, they hope to foster a small business community where owners can connect on a local and national level and help each other grow.

Combining top-shelf products and business formation services, quick processing and turnaround times, worry-free compliance, expert guidance, and dedicated customer support, ZenBusiness keeps prices affordable so you can be sure you’re getting top value for every dollar. In fact, their formation packages can save you money, while ensuring you have all the legal documents and business services you need to succeed.

Welcome to the Chamber, ZenBusiness!

EMPLOYEES HEIGHTEN THEIR FOCUS ON BENEFITS

Source: MyBenefit Advisor

It comes as no surprise that there has been a shift in priorities for many employees over the past year. The things individuals thought were important as little as two years ago no longer seem so critical, while some issues which have now come to the forefront are deemed to be absolutely necessary.

Decision makers for employee benefits have taken notice and are responding with a revised menu of benefit options. Primarily, they’re focused on enhancing benefit selections, rounding out wellness coverage, boosting mental-health coverage and adding childcare programs and tele-health options.

Employers are generally mindful of how financially stretched their employees might be and are trying to limit how much they add to their burden. Instead of raising benefit levels for all employees across the board, it may be beneficial to develop a more targeted approach and let individuals select the benefits that are best suited for them, through a voluntary benefit package as an example.

One thing is clear however… in today’s economy employees have shifted their perspective on compensation, focusing intensely on the employer sponsored benefit portfolio.

The Columbia-Montour Chamber of Commerce offers its members access to My Benefit Advisor as a solution for employee benefits, including voluntary offerings. For more information about My Benefit Advisor, visit our website at cmcc.mybenefitadvisor.com or contact Stephen Lylo at (800) 377-3539.

WHAT THE MIDTERM RESULTS MEAN FOR PA BUSINESSES

Source: PA Chamber of Business & Industry

While last week’s midterm elections produced a mixed bag for both parties, the results were marked by one consistent theme: change.

For starters, Pennsylvania’s U.S. Senate seat held by retiring Republican Sen. Pat Toomey will now be held by Democrat John Fetterman, and Democrat Attorney General Josh Shapiro will take over as Governor in January. While Republicans retained the majority in the state Senate, the state House is likely to flip to the Democrats by a narrow, one or two seat majority. And Pennsylvania will send nine Democrats and eight Republicans to Congress after losing a seat during redistricting.

Harrisburg will have many new faces come January. At least 51 state House members, or 25 percent, will be serving their first term; and, 118 members, or 58 percent, will have been elected in the last three election cycles. Only 27 state House members, or 13 percent, held office the last time the Democrats were in the majority. Of that number, 13 are Republicans and 14 are Democrats.

For the PA Chamber, this means our role as the leading statewide voice of business is more important today than ever. In the weeks and months ahead, our team will be reaching out to newly elected members of the General Assembly and Gov.-Elect Shapiro’s team to discuss public policy priorities and how we can work collectively to move our economy forward. We look forward to continuing to work with our member companies and local chambers to educate lawmakers on the importance of pro-growth policies and serve as a resource for information and guidance on key issues.

While Harrisburg will have a divided government, we know from experience that pro-business policy can advance in a bipartisan manner. In the past six months alone, we successfully enacted substantive legislation, including reducing our Corporate Net Income tax rate in half; preventing an unfair unemployment compensation tax rate hike on nearly 3,000 small businesses; and providing a regulatory framework for autonomous vehicle testing and deployment.

There is more progress to be made, including ensuring the state sticks to, or expedites, the planned CNI phase-down schedule and enacts additional reforms to make Pennsylvania’s tax code more competitive, and the Commonwealth more attractive to investment; advancing regulatory and permitting reform that will provide certainty to businesses and encourage investment; improving our infrastructure, including broadband expansion; and addressing ongoing workforce challenges , among many other issues.

###

Founded in 1916, the Pennsylvania Chamber of Business and Industry is the state's largest broad-based business association, with its membership comprising businesses of all sizes and across all industry sectors. The PA Chamber is The Statewide Voice of BusinessTM.

A Recipe for Employee Engagement

You’re busy. You’ve been spending a lot of energy trying to keep employees and customers happy. Does this sound familiar?

“Nobody wants to work anymore…”

“I was ghosted again by another candidate…”

“We’re trying to manage a really different workforce than the one that existed pre-pandemic… “

“I feel stuck trying to figure out how keep my employees here….”

“It feels like our retention model is just throwing pasta against a wall to see what sticks.”

We’ve got good news and bad news for you. First, the bad news: that pasta trick? (You know the one - that when it’s done, cooked pasta will stick to a wall?) It turns out, that’s a myth. All pasta, regardless of “doneness” sticks…which means it’s time to rethink this approach.

Here’s the good news – the Chamber has access to local experts, the hiring and leadership versions of Michelin Chefs, and over the coming weeks, we’ll be showcasing their sage advice in Chamber programming.

Employee Engagement

Take for example, Tina Welch, of Welch Performance Consulting. Tina’s next local Chamber seminar is designed to help employers create a workplace that draws employees in and fully engages them. To keep the pasta analogy going, she calls it the “secret sauce”.

In the hubbub of the holidays, it might be easy to miss programs like this – but we think that members who attend will have a leg up in determining what makes employees stay with their companies long-term, improving employee retention, no matter the business size or industry. Bonus: businesses with HR professionals can earn 1.5 SHRM PDC credits for their employees when they send them to this event.

Consider signing up for Tina’s program, here.

Leadership

Want to continue to improve company culture for current and rising managers and leaders? Don’t miss the next iteration of our Leadercast: The One Thing… follow-up sessions, where the Community Giving Foundation’s Women’s Giving Circle will facilitate discussions that were jump-started by our September event. You needn’t have attended the September event to participate, and if time is one of your most valuable assets, these sessions may just fit the bill – abbreviated to 90 minutes.

Check out the next program, called “Building the Confidence to Reach Your Dreams”, here.

Suffice it to say, with resources like these at our fingertips, we’re urging our members to take a break from baking up ideas at home, and to come and take a cooking class from the best we have, and if after reading this you’re suddenly physically hungry, we have resources for that too.

Member News – November 9, 2022

BASHAR W. HANNA APPOINTED BY GOVERNOR WOLF

Dr. Bashar W. Hanna, president of Commonwealth University has been appointed to serve on Pennsylvania's Tuition Account Program (TAP) Advisory Board by Gov. Tom Wolf. Hanna's appointment runs from September 2022 to September 2026. The board advises on the work of the Pennsylvania 529 College Savings Program, which provides families with a tax-advantaged way to help save for their children's higher education. Read more.

ENCINA RELEASES EXPECTED PROJECT TIMELINE

Construction on the Point Township facility is expected to begin in Q3 of 2023, with the building project to take place in two phases.

WALNUT STREET CULVERT STORMWATER MITIGATION PROJECT RECEIVES $60,000

This project in the Town of Bloomsburg received the funds from the Appalachian Regional Commission. Read more.

THE EXCHANGE TO HOST GUITARIST BROOKS WILLIAMS TONIGHT

Tonight, stop in to 24 East Main Street in Bloomsburg to see the Georgia-born song wrangler, guitarist, and Roots Music Connoisseur.

UGI URGES ELIGIBLE CUSTOMERS TO APPLY FOR LIHEAP

UGI encourages eligible natural gas and electric customers to apply for the federal Low Income Home Energy Assistance Program (LIHEAP) funds to help cover the cost of heating their home this winter. Applications will be accepted by the Pennsylvania Department of Human Services beginning November 1, 2022.

HOME IMPROVEMENT TIP FROM LARRY'S LUMBER!

Check out the latest blog post from Larry's Lumber, which regularly features cost-saving recommendations to keep your homes (and your employees homes) in good condition.

GEISINGER BLOOMSBURG HOSPITAL TO HOST VETERANS DINNER NOVEMBER 10

For the 20th year, Geisinger will host its Veterans Appreciation Dinner. This year's event is a drive-through event. For more information, visit here.

KEEP OUR KIDS WARM

As part of its coat request program, Central Susquehanna Opportunities has created an application form which will be accepted through November 11, 2022. Download the form.

THE BLOOMSBURG VETERANS DAY PARADE IS SATURDAY NOVEMBER 12

Forming at 9am at the Bloomsburg Geisinger Hospital, the parade steps off at 10am. A short program at the conclusion of the parade will be held at Bloomsburg Fire Hall. Floats and Participants wanted. Call 570-594-6539 or 570-594-5549 with questions.

FRIENDS OF BLOOMSBURG UNIVERSITY LIBRARY TO SHOWCASE FACULTY EMERITUS

On November 13 at 3:00pm, join Karl Beamer in the Schweiker Room of the harvey A. Andruss Library for "Forever Fire", a presentation of his decades-long career creating kiln-fired pottery. Karl is especially known for his interpretations of Japanese ceramic art. For more information, contact Robert Dunkelberger.

SMALL BUSINESS DEVELOPMENT CENTER HOSTING WEBINARS

- "Best Practices for Obtaining and Keeping Media Relationships" 11/15, 12:30pm (in-person)

- This in-person workshop will explore how to effectively communicate with the media, including what editors/producers are typically looking for in features. It's intended for business owners, event planners, and marketing managers who want to reach new audiences via print media, radio, and TV.

- "How to Make Marketing Easy!" - 11/16 - 12pm (in-person)

- Take a deeper dive into the three C's of clarity, confidence, and consistency to show you how to make marketing less of a headache, with a number of stay-sane tips to use along the way.

For these programs and more, visit here. Hoping to connect with your local SBDC? Columbia County is served by Wilkes University SBDC, and Montour County is served by the Bucknell University SBDC.

SUSQUEHANNA VALLEY UNITED WAY TO HOST BE KIND POSTER CONTEST

The contest will span across elementary, middle, and high school age groups in Snyder, Union, Northumberland, Columbia, and Montour counties. The competition will be open from October 12th through November 30th.

TOWN OF BLOOMSBURG LOOKING TO EXPAND WAITLIST FOR HOUSING REHABILITATION GRANT

The Town recently received a $500,000 housing rehabilitation grant and encourages interested residents to apply for no-cost repairs. Read more.

BERWICK'S ANNUAL SANTA PARADE - NOVEMBER 25, 2022

BIDA is the Grand Marshal for this year's event. Parade takes place at 10:30am, line-up begins at 9:30am.

T-ROSS BROTHERS CONSTRUCTION TO HOST HOLIDAY OPEN HOUSE NOVEMBER 30, 2022

Chamber members are invited to attend!

Not Satisfied with Your Current Health Insurance?

Source: MyBenefit Advisor

It's not too late to make a switch.

Open enrollment brings an opportunity to look at things from a fresh perspective. That’s what the My Benefit Advisor (MBA) program offers. Whatever your pain points are -- local insurance experts are available to help you find the solutions that fit your needs. If you are late getting started or looking at a renewal you aren’t happy about, don’t wait any longer.

Schedule a time that works for you and have a quick call with a local My Benefit Advisor expert that specializes in the type of coverage you need. Start the year off on the right foot!

###

My Benefit Advisor (MBA) is an employee benefits platform designed to guide employers through the complexity of planning, communicating and managing a successful employee benefits program.

To learn more about My Benefit Advisor, visit us online at www.mybenefitadvisor.com.

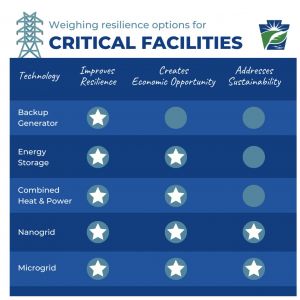

Weighing Resilience Options for Critical Facilities

Energy resilience and reliability has become more important than ever, especially with the more frequent occurrence of adverse events such as severe weather and cyber threats.

Pennsylvania's Department of Environmental Protection is searching for owners and operators of critical facilities who are interested in increasing resilience to participate in a no-cost initial feasibility study for on-site energy generation and storage at your critical facility. If you're interested in participating in the no-cost initial feasibility study, complete this brief survey to apply.

As part of the department's efforts to equip decision-makers, they've also created a pre-recorded webinar to discuss how non-traditional backup systems are different from onsite generation, storage and microgrids, to discuss grants and funding sources available for resilience projects, and to determine how resilience projects can be developed to maximize community impact.

As part of the department's efforts to equip decision-makers, they've also created a pre-recorded webinar to discuss how non-traditional backup systems are different from onsite generation, storage and microgrids, to discuss grants and funding sources available for resilience projects, and to determine how resilience projects can be developed to maximize community impact.

PA CLIMBS THE COMPETITIVENESS RANKINGS

Source: PA Chamber of Business & Industry

Source: PA Chamber of Business & Industry

Site Selection Magazine released its 2022 Business Climate Rankings, and Pennsylvania climbed six spots to No. 16. The rankings consider several factors, including workforce skills; state and local tax scheme; workforce development; transportation infrastructure; ease of permitting and regulatory procedures; land/building prices and supply; utilities; incentives; higher education resources; and quality of life.

These rankings come on the heels of the Tax Foundation’s updated analysis of how pro-growth reforms recently enacted in Pennsylvania improved our ranking among states. With the enactment of Act 53, which included the CNI reduction, as well as small business tax reforms (Section 1031 like-kind exchanges and Section 179 expense deductions), Pennsylvania’s corporate tax structure went from No. 44 to No. 27, while our overall competitiveness went from No. 29 to No. 17.

Pennsylvania also climbed six spots this year in CNBC’s annual rankings of the top states for business, from No. 23 to No. 17. The financial news outlet gave the state high marks among states for the quality of its educational systems, technology and innovation sectors, access to capital, and infrastructure, but scored Pennsylvania at the middle or lower end for economic growth, workforce, and business friendliness measures.

The PA Chamber is committed to working with our allies in state government and our members to continue making Pennsylvania’s business tax climate more competitive, including maintaining or even accelerating the CNI phase down, improving the treatment of net operating losses, and other reforms to encourage private sector investment and job growth.

###

Founded in 1916, the Pennsylvania Chamber of Business and Industry is the state's largest broad-based business association, with its membership comprising businesses of all sizes and across all industry sectors. The PA Chamber is The Statewide Voice of BusinessTM.